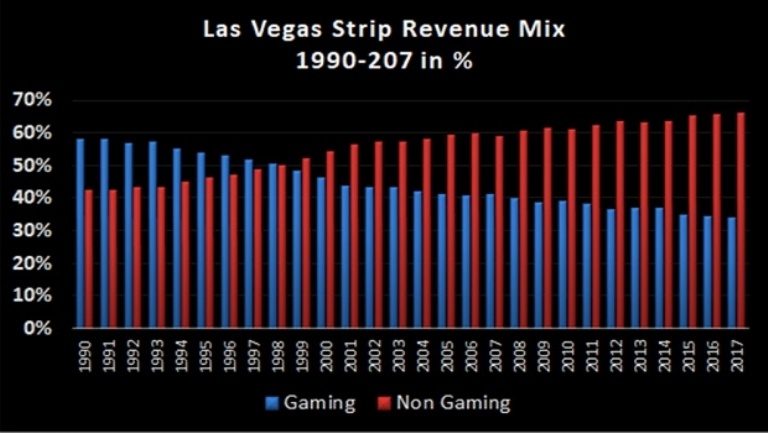

Las Vegas Revenue Mix changing over the years

According UNLV in 2016 , non-gaming revenue accounts around 66% of Las Vegas’ total revenue mix as a result of the market evolving over the past sixteen years into a more complete tourist destination with hotel, entertainment, retail, and F&B/fine dining becoming increasingly important revenue drivers.

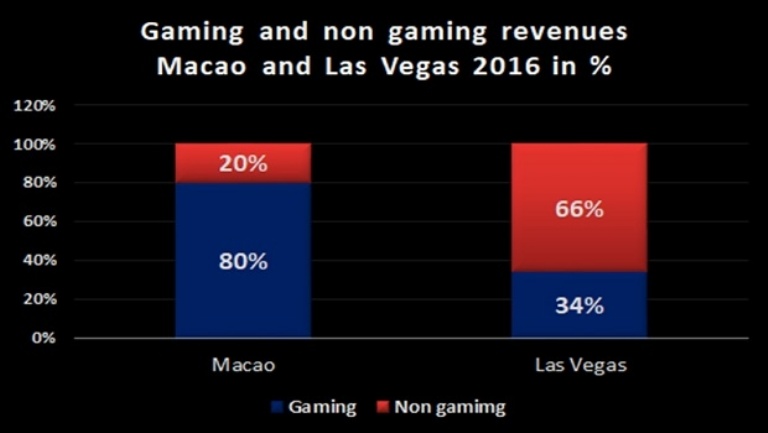

Comparing this reality in Las Vegas with another important gaming destination like Macao, we have the following charts.

At present, non-gaming tourism in Macao is only 20 percent of total, well below the 66 percent of Las Vegas. According the IMF (International Monetary Fund it would take Macao SAR about 30 years to have a similar level of diversification of Las Vegas.

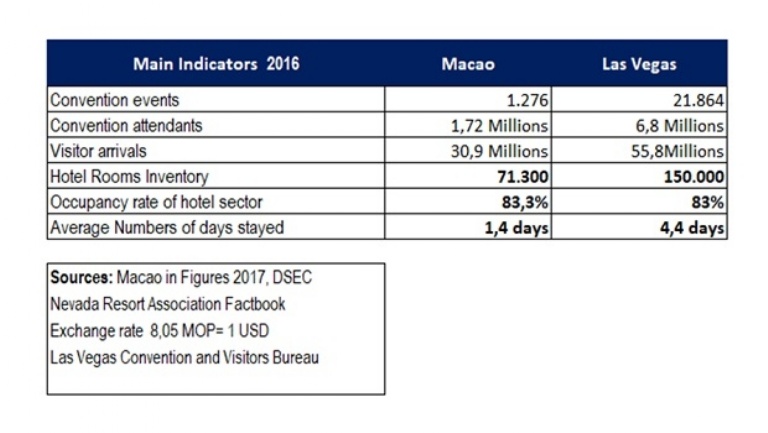

Lets’ see some indicators from both tourism destinations:

Las Vegas reinvention overtime and still more to come

According Las Vegas visitors Bureau, Las Vegas has 55,8 millions annual visitors in the form of world-class resort hotels with gambling, entertainment, shopping, fine dining, and luxury spas. Which are the Key success point?. We should mention:

Las Vegas Visitor’s Profile

This reinvention process can be observed in the visitor’s profile where only 4% come to gamble as a primary purpose of current trip in 2016. However, 69% of visitors say they have gambled at least once in the visit and 51,8% attended a show in 2016.

With more entertainment, the average number of days stayed is in 4,4 days for Las Vegas, has outpace Macao with only 1,4 days. At this point, companies in China are focusing now on a convention-based Integrated Resort business model like Las Vegas, that is helping to generate diversified cash flows and profit from mass players and non-gaming segments.

Infrastructure developments will also add to the Macau mix. focusing on non-gaming tourism. Family holidays, conventions, and exhibitions. Also, external transport links are adding to the accessibility through the very large Hong Kong - Macau - Zhuhai bridge development due to open in 2018.

Consumer behavior

With a greater proportion of first time visitors who also were younger on average, the 2016 Las Vegas visitor was much more likely than recent past visitors to take part in a variety of activities in Las Vegas, including going to other paid attractions in Las Vegas, going to bars and lounges both inside hotel-casinos and freestanding, and going to a pool party or day club.

A rise in Millennials (34% of total visitors )discovering the destination for the first time, are becoming majority spenders in today's economy but aren't necessarily interested in traditional casino gambling. The hotels are constantly striving to build new experiences to get people to come back and sample the destination again.

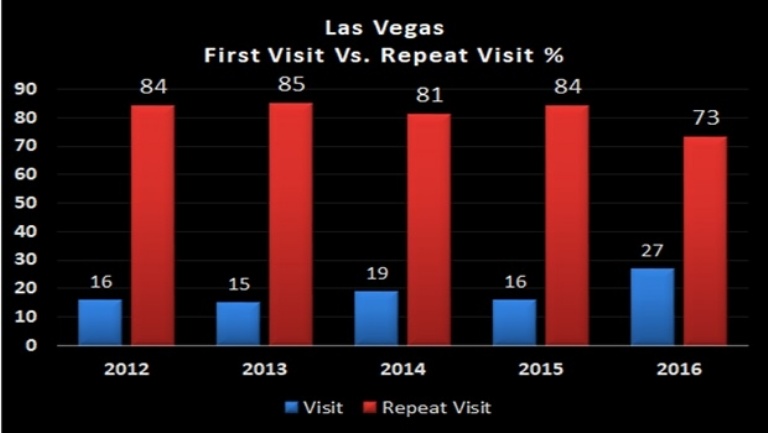

According statistics of LCVA, in 2016 73% of the total visitors are repeating visitor as we show in the chart. We also see an increase of first time visitors (27% in 2016), which shows the success of this destination as an important tourist attraction, as we can see on the exhibit:

From this perspective, future hotel-casino operators in Brasil should take note based on the experience of these two important tourism destinations to promote tourism based on: infraestructure investment along with authorities, develop non gaming activities diversification and offering a broad mix of experiences, for either premium or average clients, according their the budgets. This price point for everybody has been a consistently successful strategy for Vegas over the years.

This business vision along with considering new consumer preferences will have a highly positive impact on employment, tax collection, and tourism sustainable growth overtime.

FEDERICO LANNES

Federico Lannes – Certified Public Accountant, Master in Business Administration at (INCAE/Harvard). Member of the Institute of Internal Auditors (IIA), Ex-CEO del Intercontinental Mendoza, General Manager at Salto Hotel and Casino (Uruguay), General Manager at Altos del Arapey Hotel (Uruguay). Casino Internal Audit Manager, casino credit manager and compliance Officer at Iguazu Grand Resort and Casino (Argentina), Business Consultant at hotels and casinos (in Paraguay). Consultant at Ernst&Young (Argentina). Mr Lannes has been a scholar of the organization of American states at INCAE MBA program in Costa Rica. He has written many articles in argentinian newspaper like infobae, Fortune Magazine, Empresa Magazine, Boletim de Novidades Lotéricas (Brazil), andGames Magazine Brazil. Speaker at Brazilian Gaming Congress, 2d and 3rd edition. Specialized in management, taxation, gaming compliance and hotel-casino openings. Ex- professor of finance at the university of Palermo in Buenos Aires.