Exalted as the “greatest in the club's history”, the sponsorship of the website Sportsbet.io was announced last Friday by São Paulo. As the contract values - valid for three and a half years - were not disclosed, it is not possible to confirm the weight given to it by the board. But the sports betting industry has proven to have the strength to do so. Recently in the market, the segment grew in a meteoric way in the scenario of sponsors of Brazilian football.

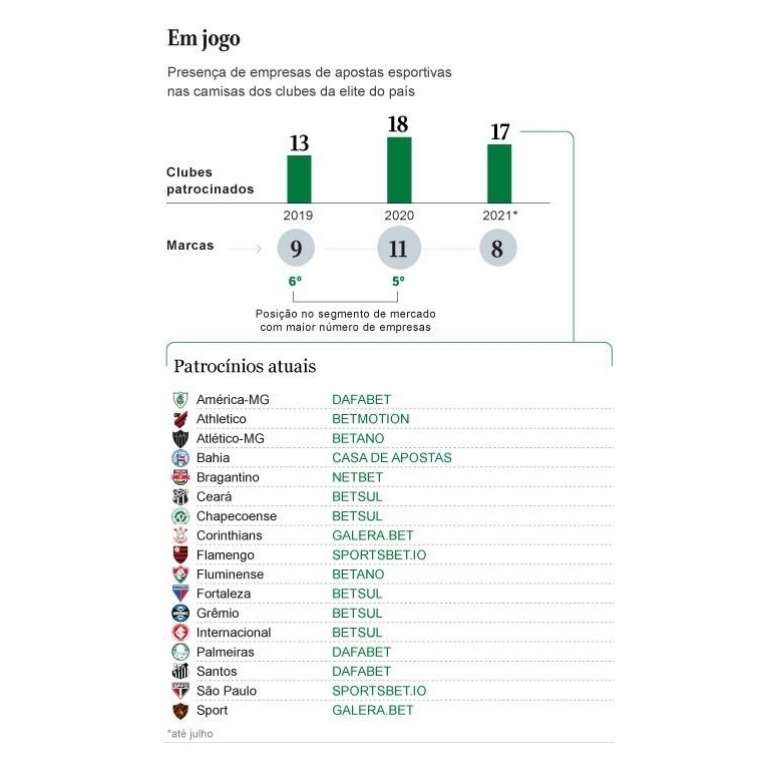

To get an idea of this rise, in 2018 there were no betting sites on football clubs' uniforms. In December of that year, law 13,758/18 legalized the sector. And, in 2019, the Serie A of the Brazilian Nationals had eight brands in 13 teams.

In the following season, marked by the impacts of the pandemic, the number of bookmakers rose to 11 (an increase of 37.5% compared to the previous year). Sponsored clubs increased to 18 (out of 20 participants), an increase of 38.5%.

"A case that portrays this boom of bookmakers well is Betsul, which in this short period of two years has already gained an extremely significant role. In 2020, the brand was the second to have more stamped uniforms from different clubs (four), only behind Unimed (health plan cooperative, with six)," pointed out Vitor Fleck, director of the research and development area of Insper Bussiness Sports, partner of IBOPE Repucom in the elaboration of the Map of sponsorship of the Brazilian Championship.

The current season reaches halfway with equally relevant numbers in Serie A. Although the number of sites has fallen compared to 2020, the sponsored remains practically the same. There are eight brands in 17 uniforms.

Although values are kept confidential, a fact indicates how the participation of this segment also grew in terms of financial volume. In 2019, only one bookmaker occupied the master sponsorship space — the most valued in the uniform. Currently, there are already five.

Problems out there

In Serie B, there are eight brands for the same number of clubs. In addition, the sites sponsor football federations, such as São Paulo and Sergipe. They are also on advertising boards in stadiums and in commercial breaks on specialized TV channels. For those who follow sports, they have become ubiquitous.

"These companies know that, when regulation is established, this will be a market in which whoever has the name in the user's head will be a thousand steps ahead. That's why they are investing a lot of money in advertising," analyzes Fábio Wolff , managing partner of the Wolff Sports agency.

Two years after leaving illegality, the segment is still awaiting market regulation in Congress. This means, among other things, that the billions of reais moved annually are not taxed.

The relationship with sport is a two-way street. While clubs and entities benefit from advertising money, sites try to gain public trust by joining them.

"Exhibition in football clubs is very important and valuable. It brings credibility," recognizes Hans Schleier, marketing director of Casa de Apostas.

In England, sites are on eight Premier League participants. But the most glaring case comes from the second division. Stoke City belongs to one of them, Bet365, which still names the club's stadium. Concern about the number of gamblers led the British government to consider stricter regulations. Among the measures discussed is the ban on the brands being displayed on uniforms.

This is what happened in Spain. And both there and in England, clubs complain about the measure. After all, losing this money represents a severe blow to their finances.

"In Europe, sports betting has been regulated for years, if not decades. Here, we were not even able to establish a format for the concession of these services. There, some countries are already starting to talk about limiting the advertising of sports betting. So, this matter may someday be on the agenda in Brazil. But it will certainly take some time," says lawyer Eduardo Carlezzo, a specialist in sports law.

In Brazil, it is still expected that the market itself goes through a sort of sieve. Still seen as a great novelty, the market attracts all types of investors. But, as in all sectors, this boom will not last forever.

"As with other new segments, as Brazilians' habit of making sports betting develops and consolidates, the market will naturally organize itself with fewer, but stronger, players," bets Arthur Bernardo, business development director of IBOPE Repucom.

Source: O Globo