Or so we’re told by Martin Storm, the chief executive of BMM Testlabs. BMM and its rival Gaming Laboratories International, or GLI, test more than 80% of gambling products worldwide, helping to keep the industry on the straight and narrow. But Storm isn’t talking to us from Sao Paulo or Rio de Janeiro, which are missing out on an estimated 3 billion reais ($560 million) for not enacting a sports-betting law in time for this year’s FIFA World Cup.

We catch the Melbourne native — over Zoom — in India. An Australian in the upper echelons of global gambling isn’t a surprise: The nation with less than half a percent of the world’s population has 20% of its slot machines. But what’s Storm doing in a country where only three out of 29 states permit casinos, and most of the real market — betting on cricket matches, historically — is underground?

Storm is there to insert a little bit of “Made in India” into the certification regulators insist on before they allow consumers near a slot machine or an online game. That’s what drives the testing market, apart from the checks casino operators conduct for internal controls. “There’s nothing worse than players losing confidence in a market,” Storm says. Out of 474 regulated gambling jurisdictions, about 120 have unique requirements. Taxes make it a high-stakes sport. “Nobody is more addicted to gambling than governments,” he adds.

Yet only a handful of jurisdictions have their own labs; most rely on the likes of BMM and US-based GLI, which at times require 100 submissions before approving a product. It’s people- and skills-intensive work that has brought Storm to India. It helps that Aristocrat Leisure Ltd., a fellow Australian firm and the creator of such smash hits as Queen of the Nile, is nearby in the same New Delhi suburb where Storm has opened his 14th facility worldwide. He wants to eventually hire between 500 and 1,000 employees in India to service the global market from there.

It seems the maker and the checker are after the same thing: a slice of India’s 5 million-person-strong outsourcing talent. The computer code running the game must be scrutinized for elements of predictability hiding behind a promise of randomness. The win rates must be analyzed to ensure outcomes are not rigged. Things were simpler in the old days, when one-armed bandits sat in a casino hall or the local pub. Being online brings its own challenges, for that’s when the operators are assessed like any financial institution dealing with money and data.

Hackers prey on gaming just as they seek to exploit any vulnerability to get into the databases of a financial institution. Online casinos have long been targets, though many attacks go unreported. From banks to oil pipelines, victims keeping an incident secret is a kneejerk reaction borne out of embarrassment or the risk of a damaged reputation. For gambling websites, that threat is even more severe. Gamblers want to know that they’re playing a fair game, and any hint that something is amiss could have them heading elsewhere. So the sites keep breaches hushed up.

While physical machines and online casinos undergo rigorous checks for how they operate internally, a huge weakness lies in the lack of network security standards. The software and hardware may be safe and function fairly, but that doesn’t mean malicious actors are prevented from getting inside and causing trouble.

In 2019, a hacking group targeted betting companies in Southeast Asia as well as Europe and the Middle East, according to Taipei-based teams at security firms Talent-Jump Technologies Inc. and Trend Micro Inc. Rather than stealing money, the digital thieves took databases and source code. The purpose, the researchers hypothesized, was cyberespionage. With access to the underlying code, a savvy group could, in theory, understand the algorithms for win-loss calculations, develop strategies to beat the casino, or simply sell that information on the darkweb.

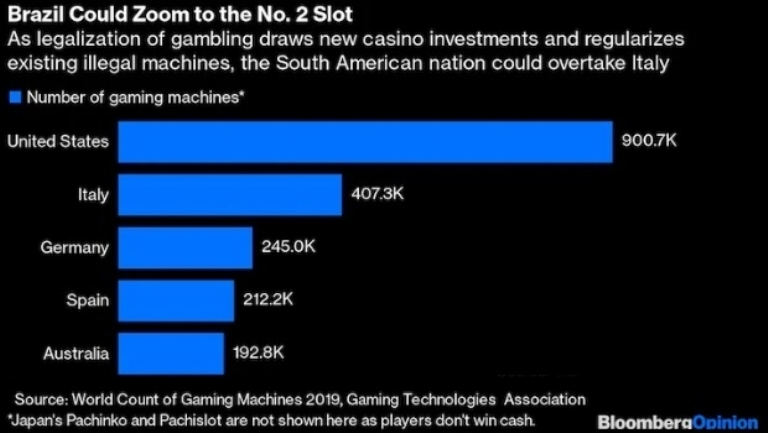

Countries have a deep-seated cultural response to games of chance. Lee Kuan Yew, the founding father of modern Singapore, was opposed to casinos because his father was a problem gambler. But in the 2000s, the Asian financial center decided to allow two integrated resorts to jazz up its nightlife — and add a whole lot of taxes to its kitty. Brazil’s outgoing President Jair Bolsanoro grew cold feet about the pending sports-betting regulation because he didn’t want to lose the evangelical vote. Lula is no fan of gambling. But having promised a fiscally responsible government, he may be loath to lose budgetary resources that look like they’re free, though they usually come with significant social costs. Betting websites think a law is coming: They’re the preeminent sponsors of Brazil’s top-division soccer teams.

Eventually, India will also figure out that resistance is counterproductive. It’s ridiculous to give up revenue from cricket, the national craze, to mafia-dominated illegal betting. A well-regulated domestic gambling industry, which will most likely be virtual, will allow the country to offer more innovative solutions to the world. Both in making games, and checking them.

By Andy Mukherjee and Tim Culpan

Bloomberg analysts

Source: The Washington Post