Although there was a decline in the third quarter of 2023 according to data collected by Tunad, the activity has been dedicating a large part of its marketing resources to television actions.

According to the study, more than 88,000 advertisements were developed by bookmakers in 2023. The research also indicated the largest advertisers in the sector in the third quarter.

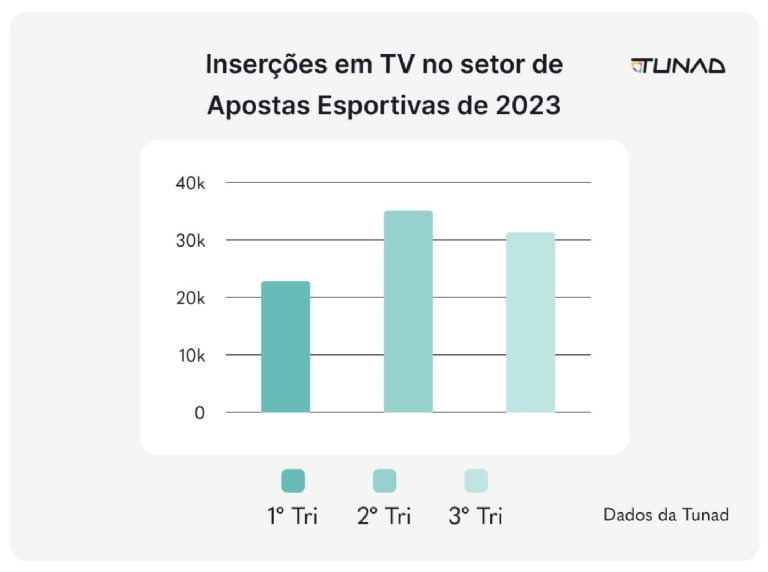

2023 Q3 recorded a notable 37% increase in television advertising insertions in the sports betting sector, compared to Q1 of the same year.

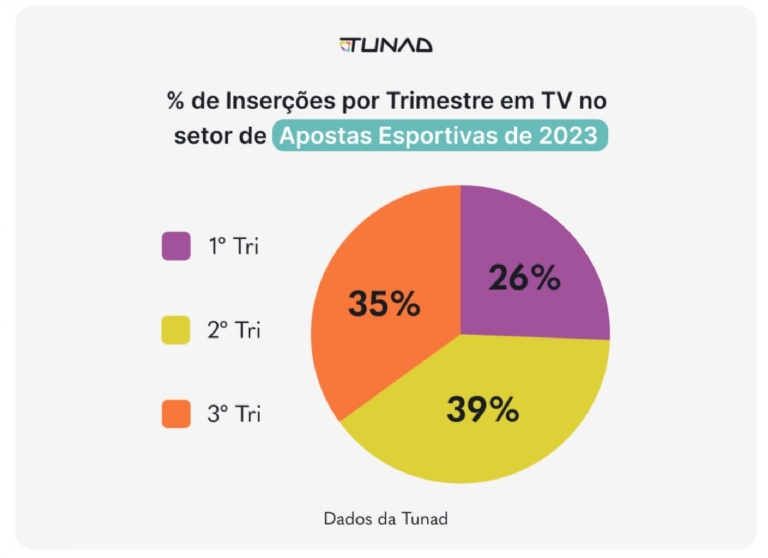

This growth represents 35% of the total advertising in the segment broadcast during the year, therefore demonstrating, in Tunad's assessment, an aggressive strategy by brands in capturing viewers' attention and consolidating their presence in the market.

Quarterly variations in TV insertions and leadership of sports betting brands

In contrast to the increase observed between the first and third quarters, there was an 11% drop in insertions from the 2nd to the 3rd quarter. This data highlights the dynamics established by Q2 of this year.

Despite this, Q3 stands out in the annual context, contributing 35% of total insertions. Even though it is below Q2, which reached 39%, this percentage remains significant in relation to Q1, which recorded 26%.

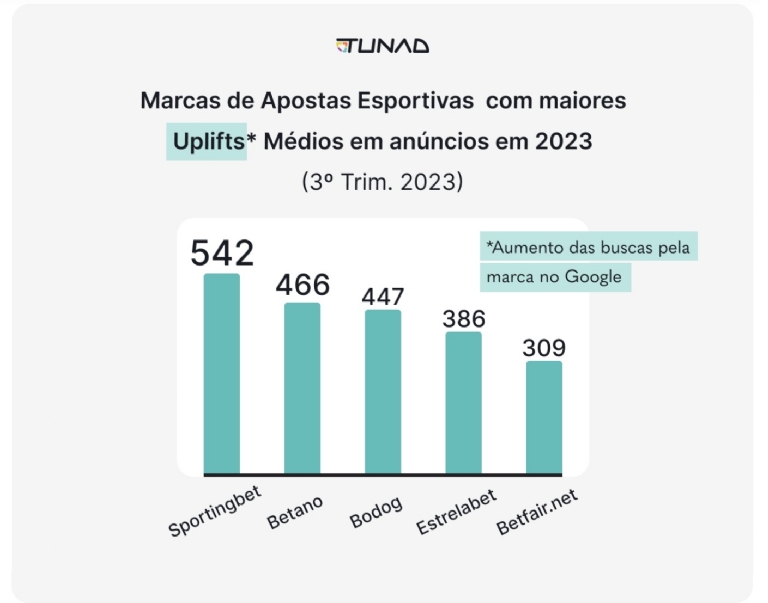

Uplift as a Consumer Reaction Metric

Uplift, an increase in brand searches on Google, is a crucial metric for evaluating the impact of television advertising on online consumer behavior.

Sportingbet occupies the first place on the podium, with more than 8,000 advertisements. Furthermore, the company highlighted an average “uplift” of 542 searches for television insertion.

Betano, with +6,000 ads and an average uplift of 466, and Bodog, with more than 2,000 (uplift of 446), were the top 3 among advertisers. Other companies that stood out in the study were Betfair (1,792), Esportes da Sorte (1,547), fantasy Cartola Pro (1,237), Betsul (1,059), Betnacional (1,007) and the leader in the poker sector, PokeStars, with 639 parts.

Final thoughts on sports betting on TV in 2023

In Tunad's final considerations on the study, the company points out that “the sports betting sector, in its continuous search for engagement and traffic, has invested heavily in TV in 2023.”

“Q3 2023 reveals an evolving industry and a competitive race among brands to capture consumers’ attention. The analysis of insertions and the subsequent impact on brand searches provides valuable insights for more effective marketing strategies and, as a result, a deeper understanding of consumer behavior,” highlights the company.

How the study was carried out

Tunad, with its audit team and advanced signal capture system, identifies and classifies commercials broadcast on open TV and PayTV. In this way, it is possible to validate the presence and frequency of brands on monitored channels, which cover a vast area and diversity of channels.

This television insertion data is crossed with variations in specific KPIs, such as Google searches, as well as other indicators. As a result, it is possible to measure the impact of a campaign in real time — the true uplift.

The research can be seen here.

Source: GMB / Tunad