With a cell phone in hand, a hunch in the head and money in the account, anyone in Brazil today can place a sports bet online. From traditional football (including women's, minor divisions and youth tournaments around the world) to darts, passing through table tennis, badminton and even eSports, among dozens of other modalities, the segment moves billions of reais in the country, but none penny of taxes reaches the public coffers.

There is an old desire of serious companies in the sector to regulate the business, which includes meeting fiscal commitments, something naturally seen with good eyes for some time by the federal government, within its permanent suffocation in the face of tight cash. Even so, the ball was stopped in the middle of the field for a long time.

Now, finally, legal gaming is about to begin. Authorized by law in December 2018, at the end of Michel Temer's term, the so-called fixed-quota bet spent the four years of Jair Bolsonaro's government running in circles in the field of negotiations, waiting for the rules and norms to guide the sector.

Under new command, the Ministry of Finance embraced the idea of regulation and its minister, Fernando Haddad, gave a deadline of until the end of March for a provisional measure to be edited and begin to put order in the situation.

In recent weeks, Haddad's team has been poring over the framework of the PM and the successive ordinances that will be issued while the main norm is processed in the National Congress.

The model defined will be that of a grant, that is, whoever wants to operate in Brazil must pay a fee, around 30 million reais (US$ 5.75m) - compared to R$ 22 million (US$ 4.2m) proposed by the Bolsonaro government-, valid in principle for five years, but which can be for more time, with an increase in the initial payment.

“The value of the grant is not a problem for those who want to work. But the market asks for at least a ten-year term,” says André Feldman, president of the newly created National Association of Gaming and Lotteries.

In addition to the obligation for companies to pay to enter the game, they will be subject to the normal taxation already established in the country, according to their billing. For bettors, the payable bill will also be determined. In the ministry, there is talk of between 10% and 20% of the value of the prize, without any type of exemption.

At the other end, the federal government is preparing a series of ordinances that will be released while the Provisional Measure is being processed in Congress. One of them will be specific about money laundering and another will deal with the manipulation of results.

Currently headquartered outside Brazil, legalized bookmakers will need to have a fixed and physical representation in Brazil, with an ombudsman department and a board present full-time in the country. The expectation is that the Provisional Measure will be edited by the end of the month. The deadline for companies to adapt to the new rules should be six months after the creation of the ordinances.

With the determination of payment of the grant and some obligations, such as minimum capital and the need for physical and fixed representations in the country, the government's expectation is that between 70 and 100 companies remain in the national market, a number that is equivalent, at most, to 10% of the betting sites that operate here, most with addresses outside the country and many in tax havens.

One of these is the galera.bet, headquartered in Curaçao, in the Caribbean. With no office space in the country, the company landed just over a year ago and has more than 2.5 million registered users on its platform.

"Here in Brazil we operate under a legal limbo, with constant concern for tax and legal issues, and we choose to operate where we have legal security," says Marcos Sabiá, CEO of the company, which stamps its marks in the Brazilian Championship and in the games of the Brazilian Confederation of Basketball. “When there is regulation, our company will have a legal representative and structure in the country.”

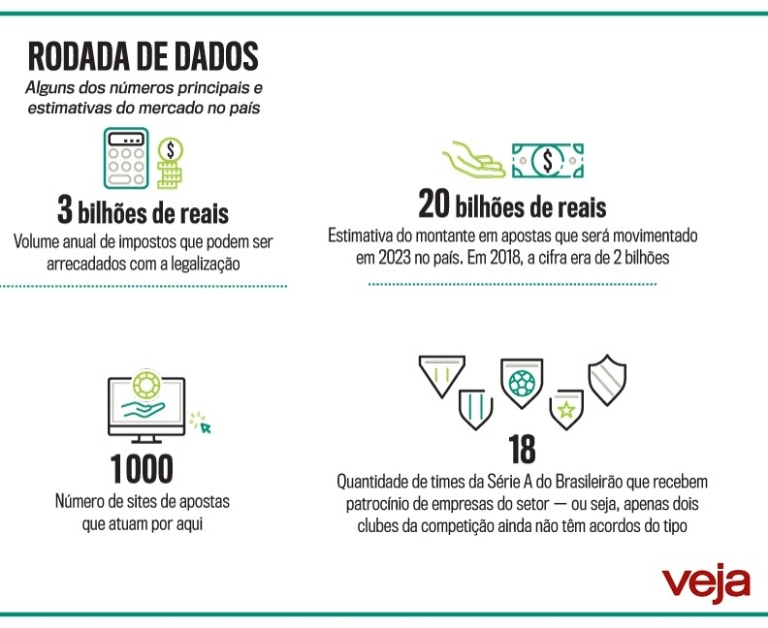

It is high time to regulate a business that has been expanding exponentially. In 2018, the sector's revenue was around R$ 2 billion (US$ 385m). Four years later, it jumped to R$ 15 billion (US$ 2.9) and projections always point upwards (see more numbers in the table).

What also increased were the sponsorship quotas. In 2021, Flamengo closed a Pixbet brand exposure contract on the top of its shirt for R$ 24 million (US$ 4.6m) per year. In São Paulo, Sportsbet.io disburses R$ 29 million (US$ 5.55m) annually for the master quota of advertising on the uniform.

In preparing the provisional measure necessary to put order in the game, Haddad's team has been mirroring examples from other nations that are more advanced in the subject. Countries like Denmark and Sweden inspire Brazil in a regulation that does not create a monopoly, but that prevents the entry of companies without financial strength to cover all the costs of the business.

The government is also going to receive help from the United States in terms of technology to resolve questions regarding the geolocation of gamblers, in order to curb the entry of pirate operators and combat fraud in state betting (each state will also be able to operate in the online market).

Business inspection continues to be a challenge here and abroad. For the system to work satisfactorily, it is important to “join in with the Russians”, increasingly closing the siege against fraud. Despite the efforts already made by the authorities, the multiplication of cases grows almost in the same proportion as the betting pool.

One of the most famous cases abroad involved Russian tennis player Yana Sizikova. In 2021, she was arrested in Paris on charges of purposely missing a game at the Roland Garros tournament.

Fifteen years earlier, Juventus, from Italy, ended up being relegated after the discovery of a match-fixing scheme. In Brazil, in 2005, the “whistle mafia”, revealed by VEJA and by journalist André Rizek, took former referee Edílson Pereira de Carvalho to jail. In the 1980s, the PLACAR magazine denounced about tricks that took place in national championship games scheduled for the old ‘loteca’ (lottery-syle game). Gave zebra, as they used to say.

Currently, the São Paulo Civil Police is investigating twelve cases of suspected attempted fraud, all in minor division games. In Goiás, the Public Ministry also investigates irregularities in three matches of Série B of the 2022 Brasileirão. These episodes led federal deputy Felipe Carreras (PSB-PB) to propose the creation of a Parliamentary Commission of Inquiry on the subject. “We can't watch and do nothing,” he justifies.

The idea, however, finds resistance in the economic wing of the government, which does not want the political noise of a CPI right now, on the eve of the final effort to legalize the online betting sector. In addition, with companies duly regulated here, inspection of the sector tends to be much more effective, including the real chances of punishment. It costs nothing even for the country to bet on common sense.

Source: VEJA