Of the 23 companies that sponsor football clubs in Brazil, the market estimates that 10 of them (which currently support 13 teams) may leave the market because of the amount required by the license.

Brazil’s Minister of Finance, Fernando Haddad, met this week with representatives of the ANJL (National Association of Games and Lotteries) with the participation of giants Betano and Betnacional. Besides them, Galera.bet, Conta Zap, Zap Bets, Vai de Bet and F12 Bet also attended. They discussed the regulation of gaming that should be formalized by the government possibly in the first week of April, through a provisional measure (PM).

The main points of the PM to be signed by President Luiz Inácio Lula da Silva (PT) in April should be the following, according to what has been released so far:

License - bookmakers will have to pay for a license to operate in the country. Currently, the charging of a R$ 30 million (US$ 5.7m) license (valid for 5 years) is under discussion;

Headquarters - companies must have a CNPJ (local tax number), with a minimum capital to be defined, and head offices in Brazil;

Advertising - bookmakers who do not comply with the requirements will be prohibited from advertising of any kind;

Taxes and collection - companies and bettors will pay taxes. According to government and segment estimates, the collection could reach almost R$ 10 billion per year. But it is unclear where and what the money will be used for. It is also not known how much of the money raised will go to the federal government, state governments and municipalities.

Taxes and collection - companies and bettors will pay taxes. According to government and sector’s estimates, the collection could reach almost R$ 10 billion (US$ 1.9b) per year. But it is unclear where and what the money will be used for. It is also not known how much of the money raised will go to the federal government, state governments and municipalities.

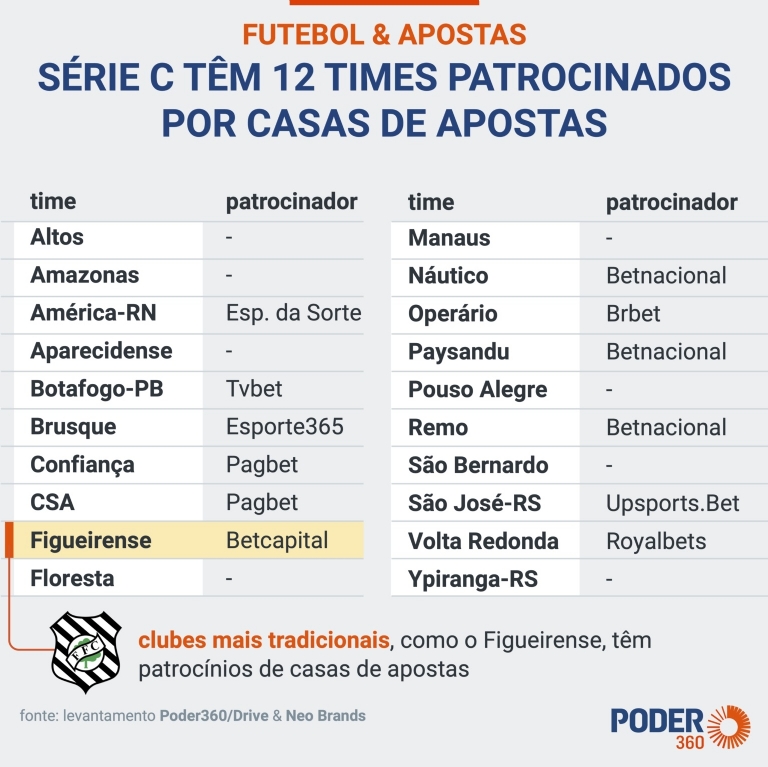

According to betting market estimates, the value of the license of R$ 30 million (with validity of 5 years) can be supported with cash payment by a maximum of 13 companies that operate in the field and sponsor teams from series A, B and C of the Brazilian football. Regarding the other 10 companies that sponsor 13 teams, there are doubts as to whether they will be able to afford this license payment.

If the value of R$ 30 million is confirmed for each license and all 23 bookmakers can pay, the government will raise R$ 690 million (US$ 132m). It seems to be a lot of money, but it is an almost negligible amount compared to the Union Budget, which in 2023 is R$ 5.345 trillion (US$ 1.017tr).

In short, it's little money for the government, but a lot for some companies.

Smaller operators could perhaps adhere to the new requirements if the license fee was similar to what is charged in countries where these bookmakers are headquartered.

The charge for a R$ 30 million license far exceeds the amount that bookmakers pay to operate from countries such as Malta and Curaçao. In these locations, companies pay license fees of no more than US$50,000 per year. In addition to the license itself, it is possible to obtain sublicenses, of around US$ 15,000 per year, from which the bookmaker “hosts” itself in a parent license along with a group of other ventures in the sector.

The immediate effect of possible Brazilian legislation, if the text of the PM is the same as it has been disclosed, would reduce competition in the Brazilian online betting market. Many companies may simply prefer not to incorporate what is being proposed.

However, these smaller companies will continue to operate in other countries and be accessible to Brazilian consumers, without paying taxes – as they are today. They just won't be able to advertise in Brazil. But they will continue to be available on the internet from servers abroad.

If this situation is confirmed, the government will lose revenue. Consumers will have fewer options in the market. But the main losers will be the football clubs.

With a ban on advertising for bookmakers who don't get the license, teams will have to look for another source of revenue to sustain their operations. It will not be a trivial task. The amounts paid by bookmakers can be up to three times higher than those of other sponsors, such as banks.

It seems that the logic that has guided the government's current proposal is to transform the fee charged for the license into an extra source of revenue (in addition to taxes). As I wrote above, the value will make little difference to the government, but it will have the direct effect of excluding several companies from the Brazilian market.

Fernando Haddad is committed to regulating gambling in the country. The initiative is commendable.

With the right regulations in place, Brazil could become a major player in the global sports betting market, benefiting all of society. But the focus should perhaps be on charging taxes on company revenues – and not on the value of licenses that will be issued for enterprises to be registered in Brazil.

João Rodrigues

Publicist, operates in the sports market for 8 years. He worked in the marketing coordination of São Paulo Futebol Clube, at Netshoes / Magazine Luiza and as Director of Marketing at Pronet Gaming (leading company in online betting platforms in the world). He created NeoBrands in 2021 and serves as CEO of this Brazilian advertising agency focused on sports marketing and working with partnerships and sponsorships, campaign creation, social media management, art direction and personalities from the world of sports.

Source: Poder360