The value of the global iGaming industry has grown exponentially in recent years, and the COVID-19 pandemic being a major contributing factor as thousands of players flocked to online platforms. Additionally, the legalization of sports betting in relevant markets (USA, UK, France, Italy, among others) has created a highly attractive segment within the sector.

In Brazil it was not different. The sector has been growing by leaps and bounds since December 2018, following the approval of Federal Law No. 13,756, which legalized online sports betting. The next step, that would be a full regulation of sports betting in the country, has been an important agenda of political discussions since then and a final version of the bill is expected to pass still in 2023.

While regulation alone may not represent the spark to start a movement of increased concentration in the industry, a regulated sector is much more attractive for large global players. With regulation in place, it becomes quickly an imperative for big players to seek leadership position in a market with high growth potential and relevant scale within the industry. Important to note that this concentration movement can happen regardless of whether the regulatory body limits the number of licenses distributed – a factor that could further accelerate concentration in the sector.

The concept of industry consolidation is not something new. In other sectors it has resulted in a very small number of large companies that share huge markets with each other. And in the global iGaming industry it will be no different. The rise in merger and acquisition (M&A) activity in this sector has been a trend since the 2000s, when giants such as Playtech and 888 Holdings made their first acquisitions.

In the United States, which has recently regulated sports betting, M&As saw a subsequent take-off. Some more recent examples include Flutter Entertainment's acquisition of FanDuel, DraftKings' acquisition of SBTech, and Caesars Entertainment's acquisition of William Hill. Companies that previously lacked a strong presence in the sports betting and online gaming space are seizing opportunities to enter or even expand market share in the United States. Wynn Resorts bet on the acquisition of BetBull, a leading sports betting platform in Europe, to enter the online segment and take advantage of market growth in the US.

The consolidation of the North American market is even clearer when we analyze market share. Currently, the top four sports betting operators - Fanduel, Draftkings,BetMGM, and Caesars - together have more than 85% share.

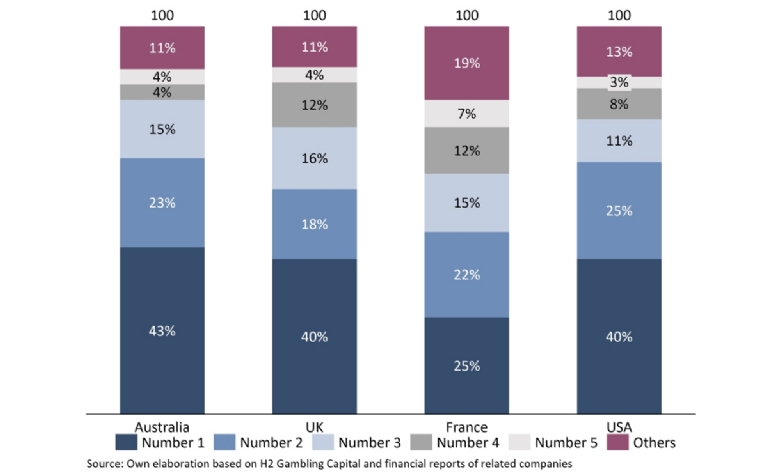

However, concentration is not just a North American market phenomenon. It takes a quick glance at the acquisition history of large companies like Flutter, GVC Holdings, Entain, Playtech and Kindred Group to discover that they have acquired startups and several other operators to reach a leadership position in the segment. Figure 1 shows that the high concentration seen in the top 4 operators in the US is common to several other regulated markets such as the UK, Australia and France.

It is important to note, for example, that Flutter Entertainment has more than 40% market share in the US, UK and Australia. Although in Australia this market share was obtained organically, growth through M&A was the company's main instrument in acquiring stakes in the United Kingdom and the United States, with the merger of Paddy Power with Betfair and with the acquisition of Fanduel, respectively.

In Brazil, we estimate that there are currently more than 450 websites in operation. In addition to high fragmentation, the sports betting sector in Brazil is also characterized by high availability of substitute products and switching costs that are often negative. The majority of companies do not have full control over the technologies used in their operations, offering commoditized experiences that make it difficult to retain users.

Despite that, companies operating in the iGaming industry in Brazil can be extremely attractive in mergers and acquisitions, especially when the buyer's main objective is access to players. In addition, the need for a local license to operate in the Brazilian sports betting market can create an excellent opportunity for companies that come out ahead in this process. Having a license for sports betting in Brazil will be a differentiating factor that can make the company even more attractive to potential buyers who want to enter the Brazilian market, but run into the lack of a license.

In fact, the regulation can open a unique window of opportunity for operators that want to exit their businesses, or even join global giants that are interested in exploring the Brazilian market. With a population that exceeds 200 million people, Brazil is a market with unique potential for scale the business and generate high revenues.

The high profitability of the largest iGaming companies may be another stimulus for outstanding transactions. The large companies in the sector not only have balance sheets with excess cash, but also operate with extremely high valuation multiples. Flutter Entertainment, a publicly traded company on the London Stock Exchange currently operates with an EV/EBITDA multiple of 36x and has approximately USD 1 billion of cash available. This scenario will certainly help industry leaders to make aggressive acquisitions to achieve their strategic objectives.

Good preparation for M&A can change the dynamics of the process and help companies close better deals. Not to mention that most of the actions that make a company ready for the M&A can also help improve operational efficiency.

There are key elements on this preparatory process. Whether you want to buy, sell or merge, your financial and accounting systems need to be in order. You will also need well-documented operational processes and good working capital management practices.

Having a clear strategic plan is also critical. There are several possible paths for revenue growth and increased profitability of your company. Choosing the ideal path starts with a clear understanding of your future goals. Whatever the case, defining where the company wants to go in the coming years can help its shareholders and management team assess whether an acquisition (or sale) is the best way to achieve it.

An M&A process can take between 6 and 12 months to complete. However, planning and preparation can take 3 to 4 times longer. And to be well prepared to go to market, it is essential to choose who is going to be part of the “war team” in the negotiations. This team can be formed by internal and external professionals. Few companies have the expertise to grasp the complexities of a transaction, and thus, hiring a team of M&A specialists can add a lot of value. These consultants play a critical role in aiding with preparation, due diligence, identifying risks and opportunities, and aligning shareholder interests throughout the negotiation process.

In short, the Brazilian gaming and betting market is making great strides towards regulation. Clear and well thought rules can contribute to an even faster growth of the sector. Given this perspective, the consolidation of the games industry will be inevitable. Diligent preparation allied to a well-designed strategy will be essential for those who wish to take advantage of the expected intensification of mergers and acquisitions in the sector. Having advisors with extensive experience in the iGaming sector and at M&A processes can make the difference when it comes to extracting more value from a transaction.

Victor Oliveira

Partner at FGo Advisors and Matix Capital, holds a BS in economics from FACAMP – Campinas, Brazil and an MBA from the University of Cambridge – Cambridge, United Kingdom. His area of expertise lies in the realm of structuring investments, corporate restructuring and M&A. FGo Advisors is a boutique strategy consulting boutique with a wealth of experience in mergers and acquisitions, home to a team of professionals with diverse capabilities who can guide you through the entire M&A process.

Natalia Nogues

Graduated in Graphic and Web Design from ORT University – Montevideo, Uruguay; MBA in Strategic and Economic Business Management from FGV University – São Paulo, Brazil, and Managing Partner of Control+F5, a company that offers a services hub in the gaming industry in Brazil. With 15+ years of experience in IGaming industry in LATAM, Natalia is a senior consultant and helps companies to enter, operate and expand within the Brazilian market.

Source: GMB