Since the market usually refers to the “taxation” of fixed-quota bets (sports betting), this article aims to bring a legislative historical overview and conceptualize what is a tribute and what is the social destination of the predicted rates in Law 13.756/2018.

The publication of Provisional Measure (PM) 1.182/2023 was an important step for the regulated Fixed Odds Betting market – AQF in Brazil. Although the granting of the activity to the private sector, and other regulatory aspects, still depend on acts of the Executive Branch, the PM edited by the government was essential to prepare the ground, as some of the matters dealt with in fact depended on the provision at the level of law, especially to combat informality and the taking of bets over the internet, by foreign sites.

Incidentally, it should be noted that the use of the provisional measure was a constant in the history of this lottery modality from the beginning: Law 13.756/2018, originated in PM 846/2018, removed sports betting from illegality, typifying it as a “betting system relating to real sports-themed events”; Law no. 14,183/2021, resulting from the conversion of PM 1034/2021, was responsible for changing the calculation basis and rates of the AQF.

And, with the brand new PM 1,182/2023, were created sanctions, criteria for advertising and marketing, restrictions on operations by bookmakers based abroad and, furthermore, new tax rates and destinations/transfers were foreseen. The PM will be appreciated by the Legislative (art. 62 of CRFB/88), but it takes effect from its publication.

However, some economic and financial analyses, commissioned by businessmen willing to invest in the sector (as published on BNL and GMB websites), point to an “excessive taxation” in the event that the original text of PM 1,182 is approved, especially for small and medium companies. Consultancies even consider the high “tax burden” levied on the exploitation of the lottery activity as an impediment to the viability of the business.

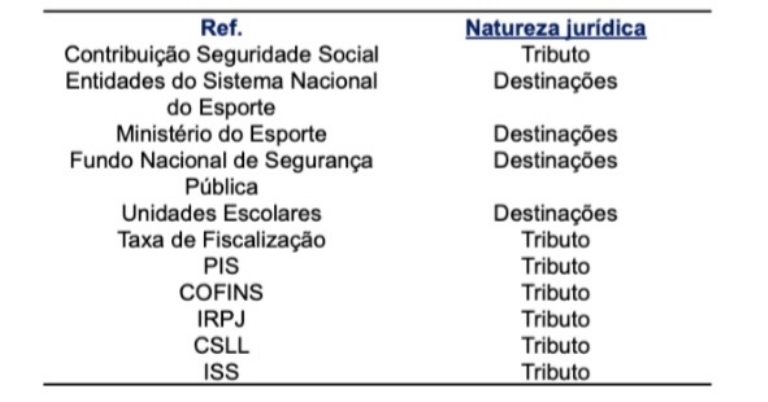

In this regard, the Provisional Measure published establishes the incidence of the sum of 18%, between taxes and transfers, on the Gross Gaming Revenue (GGR), namely: contribution to social security, more allocations to the national sports system, Ministry of Sport, National Fund for Public Safety and for School Units. It is worth remembering that the GGR consists of the proceeds of the collection, minus (i) the amount allocated to the payment of prizes and (ii) income tax on the prize. Operators will be owed a maximum of 82% to cover current expenses.

But, in addition to such rates, there will be an inevitable incidence of federal (PIS, COFINS, IRPJ, CSLL) and municipal (ISS) taxes, in addition to the Inspection Fee provided for in art. 32 of Law no. 13,756/2018, estimating the achievement of up to 30.82% of the GGR. In this context, the Brazilian tax reform (PEC 45) is pending, which may ultimately result in the commitment of approximately 50% of total revenue (28.04% of VAT plus the provisions of Law 13,756/2018) – not counting the tax (IR) on the prize (withheld by the operator) paid by the bettor.

Here, finally, lies the key point: although it is current in the press to use the expressions “taxation” to refer broadly to all deductions to be made on the GGR, it is true that not everything constitutes a tax properly.

The rates referred to by the PM itself as “allocations” are, technically, specific bindings originating from the prerogative of the Executive Power of the Union to propose budget organization rules and about the public service of the Federal Public Administration, with support in art. 165, III, and 61, §1, II, “b”, of CRFB/88.

The contribution to social security levied on revenue from prognostic contests, instituted by art. 26 of Federal Law 8.212/1999, or the Inspection Fee, provided for in art. 32 of Law 13,756/2018, are unequivocally taxes. Other taxes fall into the same category, such as PIS, COFINS, IRPJ, CSLL and ISS:

This distinction is essential in view of the federal context in which lottery activity is inserted in Brazil, because since the judgment of ADPFs 492 and 493 in 2020, all States and the Federal District can explore the AQF and other lottery modalities provided for by federal law. With this, the creation of transfers and destinations (factors that directly impact the administrative aspect of the Lottery) must be defined by themselves, in view of their administrative autonomy and in line with what the Federal Supreme Court decided in the joint judgment of the aforementioned ADPFs.

In other words, although the matter is influenced by art. 22, XX and apply nationally (namely for the creation of new lottery modalities, as defined by the STF), the allocations to the Ministry of Sport, National Public Security Fund, etc., established in Law 13.756/2018, are rules applicable only at the federal level and refer only to the income arising from the lottery activity of the Union, and cannot be binding on subnational entities. Likewise, the aforementioned Inspection Fee would obviously not be applicable to the States and the Federal District, due to the triggering event being the exercise of the Union's police power over operators exercising the grant to explore the AQF modality.

This is the importance, therefore, of the Union, as well as the other federated entities that own the lottery service, paying attention to the economic adequacy of the incidence of tax rates and specific bindings on the revenue obtained from the activity, because, as already shown by the international experience, the degree of revenue commitment tends to be inversely proportional to the channeling rate.

If so far the Federal Government has adopted essential measures to prepare the ground, and Congress is already discussing the terms of the PM it will be up to the Planalto to articulate itself so that all terms of the regulation are attentive to the reality of the market.

Alexandre Amaral Filho

Rafael Biasi

Daniel Fernandes

Roberto Brasil Fernandes

Brasil Fernandes Advogados