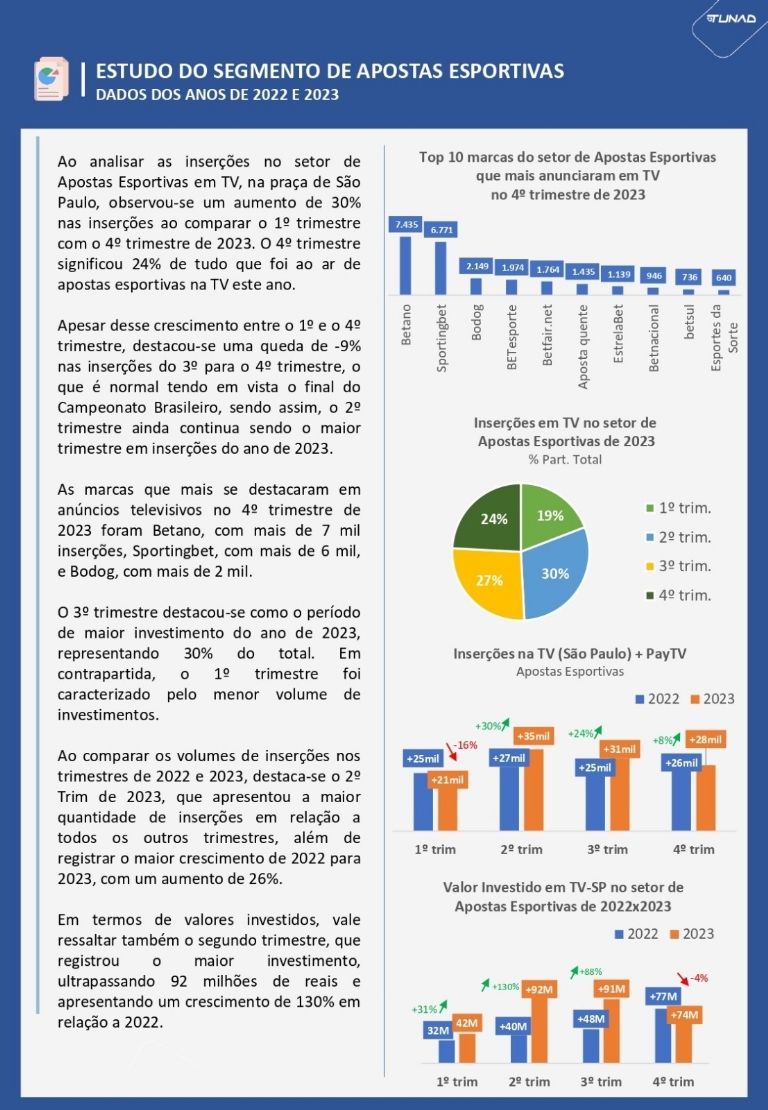

According to Tunad, despite the evident growth between the first and last quarters, it's worth noting a -9% decline in ad placements from the third to the fourth quarter. However, this decline is considered normal, especially considering the conclusion of the Brazilian Championship. Thus, the second quarter remains the period with the highest number of ad placements throughout 2023.

Betano led during the fourth quarter of 2023 with over 7,000 placements, followed by Sportingbet with over 6,000, and Bodog, which surpassed 2,000 placements. BETesporte (1,974), Betfair.net (1,764), Aposta quente (1,435), EstrelaBet (1,139), Betnacional (946), Betsul (736), and Esportes da Sorte (640) also contributed to the increase. The third quarter emerged as the period of the highest investment throughout the year, representing 30% of the total advertising spend.

On the other hand, the first quarter was characterized by the lowest volume of investments. When comparing ad placement volumes in the quarters of 2022 and 2023, the second quarter of 2023 stands out, not only presenting the highest quantity of placements compared to all other quarters but also recording the highest growth, with a significant increase of 26%.

Regarding the invested amounts, the second quarter stands out with R$92 million (US$ 19 million) and shows substantial growth of 130% compared to 2022. These numbers reflect the ascent and dynamism of the sports betting sector on television, highlighting trends and investment patterns throughout the year 2023. "The study confirms the exponential growth of the online betting market," says Ricardo Monteiro, CSO and COO of Tunad.

The survey was conducted by Tunad, which has a signal capture system for open and PayTV channels that can identify the start of commercials and automatically classify them via audio-matching, with an audit team performing the final check for result validation.

Source: GMB