GMB - You have recently hosted one of the most important events of the year for the Brazilian market on compliance and regulation, featuring top specialists from major companies in the sector. What can you tell us about this meeting, and what impact has it had?

Jessica Feil - Our Exclusivo event was a chance to bring together leading industry experts from OpenBet, H2 Gambling Compliance, GLI, FAS Advogados, and brmkt.co to delve into the Brazilian landscape following regulatory changes.

We looked at the current landscape in Brazil and its projected future growth once regulations go live in January, with data provided by H2GC. We also shared insights on essential tools for success and what is needed to thrive in the market as competition mounts. Our Brazil white paper was a key focus, sparking discussions on the most pressing concerns for operators, and importantly, reinforcing the need for comprehensive and effective player protection measures and technology that can adapt to meet local needs.

At the event, the company introduced OpenBet Locator, a key product for geolocation and fraud prevention. How would you describe this and why is it essential for any regulated operator?

OpenBet Locator™ is our proprietary geolocation technology which is designed to ensure compliance with regulatory requirements, particularly in the U.S. and Brazil. By accurately determining a player’s location, operators can prevent unauthorized access from outside licensed jurisdictions and address risks at the source.

Built on the backbone of Amazon Web Services (AWS) cloud provider, OpenBet Locator™ is a low-latency solution that empowers operators to locate and monitor customers, with the confidence that they are fully compliant with the respective frameworks of their target markets.

The technology includes fully flexible geo-fence management with high precision location tracking. Additionally, it integrates location spoofing and VPN detection, to combat fraud risks. We know easy and flexible configuration is vital for our partners, especially those looking to launch in new and complex markets, which is why delivering a service that streamlines workflows is a top priority for us.

What is Brazil’s importance to OpenBet? What services do you offer in this market?

Brazil is undeniably one of the most highly anticipated market openings of recent years and OpenBet has identified it as a potential growth area. Its large population of passionate sports fans, steady economic and technological development, and government that supports the regulation of sports betting all make this a key target. OpenBet is ready to leverage more than 25 years of experience to support operators of all sizes as they take on this new jurisdiction.

Our full end-to-end ecosystem of products features our powerful and reliable sportsbook engine, which promises unbeaten scalability and can process more than 100,000 peak bets-per-minute. Operators must be confident that their platform has near-perfect downtime and can adapt to market demands, otherwise they face being outpaced by a wave of competitors. Our offering also includes trading and risk management, data and content, and compliance tools.

Responsible Gaming is at the core of Brazil’s market opening. OpenBet’s Neccton technology is powered by AI and informed by the latest academic research to ensure operators can create a safe betting environment. The technology offers real-time player behaviour monitoring with integrated communications, such as pop-ups, limit setting functions and personalised feedback, which are scientifically proven to be effective. Neccton’s Responsible Gaming and Anti-money laundering (AML) tools make up a best-in-class solution that combines with compliance consultancy to deliver comprehensive turnkey player protection.

What is OpenBet’s current presence in the Brazilian market? Which companies are you working with?

OpenBet has been diligently preparing for many years to position itself as an expert in the Brazilian market. Therefore, we can be confident our offering is ready to meet the needs of operators. We are currently in advanced conversations with several operators who are looking to launch when the country’s regulated market goes live.

We are proud to have recently launched a new sports betting brand in partnership with Grupo Silvio Santos (GSS), one of Brazil’s largest conglomerates. With a rich heritage for delivering robust and reliable betting technology, trading content and services, OpenBet was selected by Todos Querem Jogos (TQJ) to power their betting and gaming platform due to our strong global reputation and focus on responsible gaming.

We are proud that our products and services will now be at the centre of TQJ’s new offering, delivering unrivalled experiences to engage and entertain its players. Last year, we also agreed a partnership with Play7.bet to power their new offering in Brazil.

Are there plans to open more jobs and expand in this market?

Having a local presence is hugely important for establishing close partnerships with key industry stakeholders. We continued to work to fully appreciate the local nuances and needs of Brazil and be on hand to deliver superior customer service in local languages.

What is your evaluation of the new regulations? Have you had meetings with the authorities at the Secretariat of Prizes and Bets to offer OpenBet’s expertise and knowledge to the Brazilian government?

Brazil’s regulatory framework is distinctly different to others around it. It is a modern regime which adopts many of the most successful policies from the world’s mature markets but fits well into the context of today’s betting and gaming landscape. This puts the market in a strong starting position, as operators can focus on driving strong revenues and providing a superior service, as opposed to trying to fit into outdated regulations. OpenBet maintains close and respectful ongoing relationships with regulators across many of the global landscapes in which it has partners, meaning we are on the pulse of the latest developments.

OpenBet recently published a comprehensive white paper on Brazil’s forthcoming regulated online betting and gaming market, with exclusive data and projections provided by H2 Gambling Capital. Could you highlight the 3 or 4 most relevant points from your perspective?

Player protection was a key focus of our Brazil white paper. We have invested heavily in our Protect pillar over the last year and this remains at the forefront of our operations. In Brazil, the market’s focus on responsible gaming aligns perfectly with our commitment to protecting players. From a survey conducted by Hibou, we know that 16% of respondents reported financial issues related to gambling and with other controversies marring sports betting in the country over recent years, it is essential for operators to gain the trust of players and regulators alike.

Similarly, in accordance with Ordinance No.722, geolocation compliance lies at the heart of Brazil’s regulated ecosystem. There is a requirement for operators to integrate location detection and fraud prevention technology with their platforms, to combat location spoofing, money laundering and the funding of terrorism. We remain committed to this shared aim of promoting safer gaming and geolocation compliance, and both Neccton and OpenBet Locator™ are primed to deliver superior software that achieves this.

Another key focus of the white paper is the high player load anticipated for the Brazil market. This is expected to be one of the biggest sports betting markets in the world, with 39 million player accounts projected to be active by the end of 2026, comprising 9% of the country’s total adult population. For this reason, operators need to be certain that their technology is as robust and scalable as possible.

At OpenBet, we have 100% uptime during all major sporting events and remain flexible to the needs of our partners. This will be essential for them to successfully achieve their objectives in the Brazilian market. Additionally, higher transaction volumes pose significant risks, but our Managed Trading Services (MTS) enables operators to offload the operational responsibility of their trading and risk to a team of more than 100 expert traders, ensuring peace of mind.

Importantly, we guide readers through what is needed to secure the competitive edge. We know that there have currently been 113 license applications made, and authorizations are set to begin from November 2024. As well as scalability and reliability, operators must leverage localised content as a key differentiator. Content should be tailored to the regulatory requirements and preferences of each state. Our industry leading BetBuilder is one of the best ways to deliver the widest sports coverage in the market, with coverage across over 11 sports, 12,000 selections, and billions of different combinations. This key engagement tool delivers an unrivalled 22% margin across all sports.

Why will the scalability of sportsbook platforms be a critical operational challenge in Brazil?

The market looks promising and is the talk of the industry, but individual player betting values are expected to be much lower than other global markets. In 2026, the average onshore online GGR per adult is expected to be $34 USD in Brazil, according to H2GC data. In comparison, it is projected to be $592 USD in New Jersey, US, $163 USD in the UK and $211 USD in Australia. This means that operators must accommodate higher player volumes in order to drive strong revenues.

Equally, cost per acquisition is estimated to be around $63 USD, which means that while it is on the lower end of the scale, operators must fight to keep players from churning to competitors. A platform that is reliable, intuitive and fast will prevent friction and loss of players.

H2GC also suggests that Brazil’s online betting market is projected to reach US$10 billion in GGR by 2029. Can we define it as one of the most important and lucrative markets in the world?

Only time will tell how the market in Brazil evolves. It is among the largest new countries to open for regulation in recent years and anticipated to be one of the most important territories for key stakeholders. Regulatory and operational costs will likely have some impact on the market’s potential growth, but we believe it could sit alongside other top markets in the world in terms of size.

At which upcoming international sector events can OpenBet specialists be found?

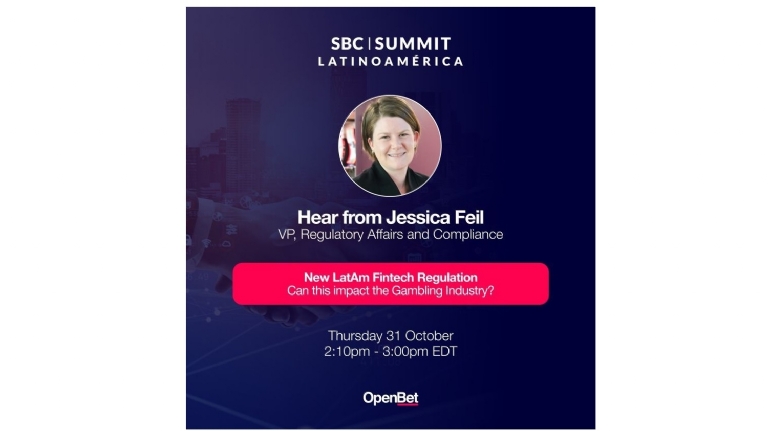

Members of the OpenBet team will be in attendance at SBC Latinoamerica in Miami, from 29 – 31 October this year.

Source: Exclusive GMB