A bingo game in the physical world has easy rules: the prize is announced in advance, the cards are distributed indiscriminately, the balls are drawn live, while the player scans the rows, columns and diagonals of the piece of paper in his hands, hoping to be the first in the group to shout "bingo!"

In the world of 'Bets' - as operators or sports betting and iGaming are called in Brazil - the complexity is much greater. Between those who "distribute the cards" and those who are eager to "complete a four-number game", there are at least a dozen companies besides the operator (Bet, as they are called in Brazil), such as the game developer and the platform where it is hosted.

With the determination of the Ministry of Finance to only allow bets that comply with law no. 14.790/2023 to operate in the country, starting October 1st, 'Bets' such as certifiers and online payment platforms (fintechs) specific to this market are starting to gain ground.

Through the control exercised by these companies, it is possible to identify, for example, suspicious plays such as those involving Flamengo player Bruno Henrique, investigated by the Federal Police for possible match manipulation that benefited family members.

The certifier's job is to ensure that at least 85% of the money bet goes back to the players (a rule called RTP, from the English "return to player") and that the game is inviolable by fraudsters. Payment platforms, in turn, must ensure transparency for players and for the Central Bank's regulatory institutions.

When registering with bet, players must confirm their data to ensure that the game is not used for money laundering. It is forbidden to use the CPF (Portuguese for "Natural Persons Register") of deceased individuals, minors or politically exposed individuals, such as those who hold public office.

The account from which the money is withdrawn to place bets must be the same one that will receive the prize. Each user can only register one account, so that bet is able to attest to the origin of the money.

The two largest 'Bets' associations in the country – National Association of Games and Lotteries (ANJL) and Brazilian Institute of Responsible Gaming (IBJR) – have proposed the use of facial recognition to verify whether it is the registered bettor who is placing each bet. The measure is not required by the Treasury's regulations and would be a sign of the sector's firm stance against possible illegalities.

"Regulation has opened the doors for serious companies that work with gambling abroad to come to Brazil, because now the rules are clear," says Leonardo Baptista, CEO of Pay4Fun, an online gambling payment platform that has been authorized by the Central Bank to operate as a fintech. He cites the American groups MGM and Caesars as examples.

Baptista criticizes the vacuum created since the legalization of gambling in 2018 until the creation this year of the Secretariat of Prizes and Betting (SPA), linked to the Ministry of Finance, which will enforce law no. 14,790. In this scenario of accelerated and disorderly growth, gamblers have lost assets and become addicted.

"No one is going to get rich from gambling, that doesn't exist. The influencer who goes to social media to say that he won a Porsche with bets deserves to be arrested," he says. "Gambling is for fun, like going to the movies or watching a football match."

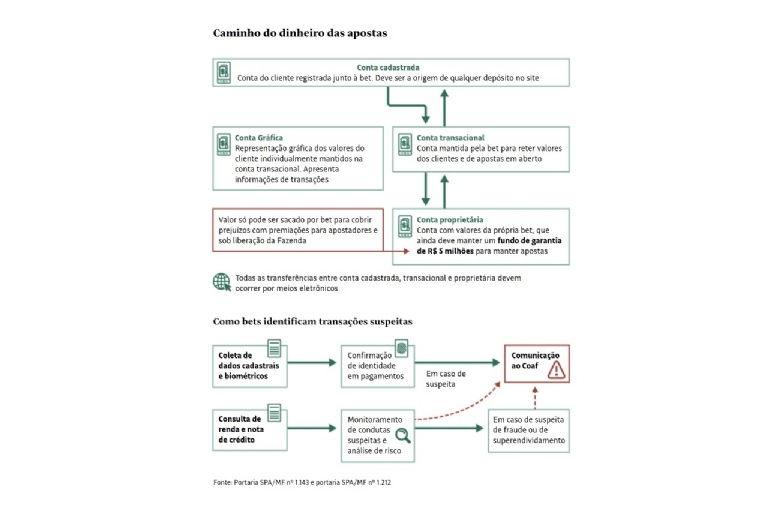

Baptista describes the path of money from 'Bets', within a legalized world. About 95% of transactions are made via Pix, the rest are bank transfers. The money leaves the user's bank and goes into the payment platform's account, which notifies the operator. Bet deposits the amount into the user's account, called a transactional account.

"The money is deposited with us. Every day, we are required by the Central Bank of Brazil to close ['bets' accounts] and buy the balance in National Treasury bonds," he says.

After the game, if the user loses, the balance between losses and gains belongs to Bet, which contacts the payment platform to say where it wants to receive this balance. "If the money is to be sent abroad, it goes through the exchange bank and pays IOF."

On the website, each player, in turn, must have access to their own information in the so-called graphic account. There, they can consult:

1. History of the last 36 months of deposits and withdrawals of financial resources, the amounts of bets made and the prizes received.

2. Value of open bets (relating to games that have not been concluded)

3. Available balance — this amount must be delivered to the player, in case of withdrawal, within a maximum of 72 hours.

A bet works with more than one fintech. Betting market executives say they prefer to hire several, to avoid problems. "If a mistake is made, the player changes sites," says EstrelaBet's marketing and product executive, Renan Cavalcanti. "We work with three payment services to have a resilient system."

Among the certifiers, one of the largest is the American GLI, founded 35 years ago. "We have a global presence," says Valter Delfraro, GLI's Executive for Government Relations and Business Development in Brazil.

The company works as a technical audit, to determine whether the game is complying with all the country's legal standards — hence the name of the activity "laboratory." "We have 24 laboratories around the world, with 1,500 employees," says Delfraro. The certifier must be hired by the operator itself, the game developer and the platform.

"To certify that the RTP of a game is 85%, for example, we need to simulate millions of plays, and at that point we use automation. But the verification of the legislator's requirements, whether they are met or not, is done by an engineer, who will test the platform", says Delfraro.

Suspicion of money laundering links 'Bet' to Coaf

According to the regulation, operators must have a compliance channel (compliance with the legislation) linked to Financial Activities Control Council (Coaf), an agency linked to the Central Bank, in order to report possible signs of money laundering.

The architecture against money laundering prevention is the same as circular nº 3.978 of the Central Bank, according to Demarest Advogados partner Fabio Braga. "The Ministry of Finance, in a very appropriate way, instead of reinventing the wheel, simply delegated to the Central Bank's own structure the task of regulating this market."

According to the regulation, operators must have a compliance channel (compliance with the legislation) linked to Coaf (Financial Activities Control Council), an agency linked to the BC, in order to report possible signs of money laundering.

The architecture against money laundering prevention is the same as circular nº 3.978 of the Central Bank, according to Demarest Advogados partner Fabio Braga. "The Ministry of Finance, in a very appropriate way, instead of reinventing the wheel, simply delegated to the Central Bank's own structure the task of regulating this market."

"Payment institutions that enter this business will do everything right, because it is very easy for the Central Bank to revoke authorization," says Wagner Martin, vice president of Veritran, a company that provides security and identity confirmation services for banks and, now, for 'Bets'.

In addition to verifying identity, payment platforms will have to check the customer's income information with banks and their credit rating with credit bureaus, such as Serasa (Brazilian credit bureau). Based on this data, each transaction must undergo a risk analysis for infractions – in addition to money laundering, terrorist financing and sports manipulation.

"The Brazilian fintech market must adapt quickly, because it already has a great deal of experience in preventing bank fraud," says Martin.

If the transaction falls under the Coaf's scrutiny, the agency can contact the authorities. Control depends on effective supervision by the Treasury. "It is a market that will greatly need these regulatory guidelines to develop well, avoiding overexposure of consumers to debt and criminal activities," says Braga.

The Treasury Department, when establishing the separation of players' accounts, aimed to make it clear which money belongs to the bettor and which to the bookmaker.

This protects the player from the risk of losing his money if the betting company goes into receivership or declares bankruptcy. The website is also prohibited from buying shares or making investments with the player's money.

The separation of assets also simplifies the government's tax collection, according to specialized lawyer Pedro Porcaro, from the Madrona Fialho Advogados law firm. "It was a design that was carefully thought out in terms of tax collection, which is easier with all operations digitized."

Source: Folha