Why were 2022 and 2023 such pivotal years for Brazil's iGaming market growth? In 2018, a law was passed to allow online sports betting, but the lack of regulation held the market back. Fast forward to 2022: President Luiz Inácio Lula da Silva enacted Provisional Measure No. 1182, bringing the 2018 law into effect and officially legalizing sports betting nationwide. Then, in December 2023, Brazil’s Chamber of Deputies approved a bill to regulate online gambling, including online casinos, introducing a tax on online betting profits as part of the regular regulatory framework.

Today, new regulations in Brazil require iGaming operators to meet strict compliance standards. Although this means more rules to follow, a well-regulated gambling market brings many advantages. Atlaslive is actively exploring this market's potential and its benefits for all industry players. What’s more, the company monitors regulatory changes and strictly adheres to all legal requirements to ensure our business operates within a secure and lawful framework.

Understanding the market deeply is a powerful tool for building a smart, flexible iGaming platform that can address the specific needs of any country, region, or continent. This article is a valuable source, offering accurate, up-to-date statistics, insightful analysis of key industry metrics, and a clear view of Brazilian trends that drive the iGaming industry forward.

Brazil’s Betting Boom and a Close Look at GGR and ARPU Trends

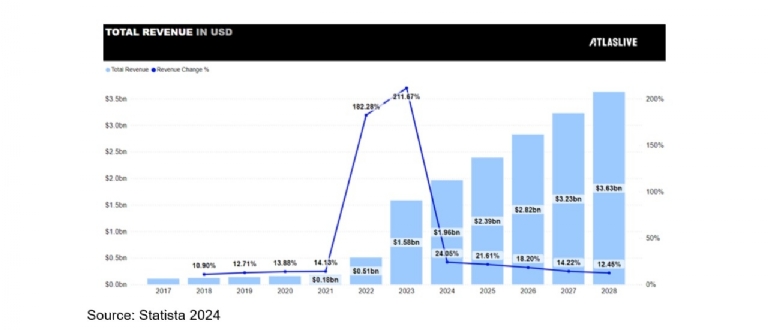

This chart clearly shows the dramatic spikes in Brazil’s GGR growth in 2022-2023, as mentioned at the beginning, along with the factors that influenced this sharp increase. These peak values are the highest not only in the region but also worldwide, indicating that players in Brazil had a strong interest in new types of gambling. However, the GGR growth rate drops sharply after these peak periods.

Brazilian fans are passionate about football, and they follow their favorite teams and players closely. When online sports betting was legalized in 2022, these same dedicated fans eagerly moved from cheering on the field or behind screens to actively placing bets. This surge in revenue is unique, a phenomenon the world hasn’t seen replicated in any other country. Before these changes, there was an online lottery option, but it never gained a large following and has remained at a stable level without major growth.

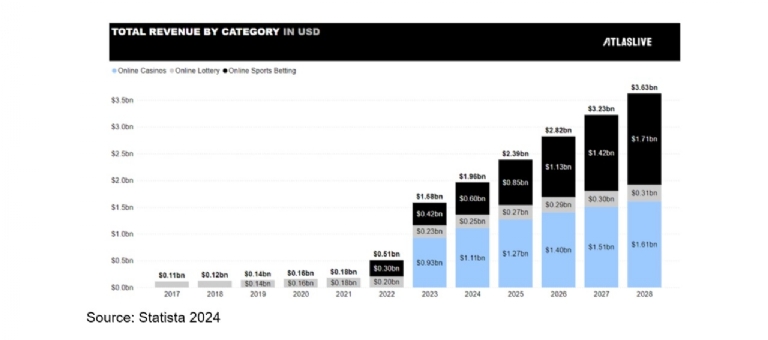

Interest in online sports betting and online casinos in Brazil is expected to remain high, with Gross Gaming Revenue (GGR) continuing to grow. Online sports betting, in particular, is showing faster and more stable growth, especially since the peak in 2022. This trend hints at a strong demand for sports betting among Brazilian players, likely driven by the popularity of various sports, especially football, and major sporting events in the country.

Since 2023, Brazil has led South America’s GGR growth, contributing about 40% of the region’s total GGR. This makes Brazil a crucial focus for investment and market development to secure the overall success of online gaming in the region. By 2028, Brazil’s GGR is projected to reach $3.63 billion, nearly half (45.1%) of the region's expected GGR of $8.04 billion, underscoring its pivotal role in the South American iGaming environment.

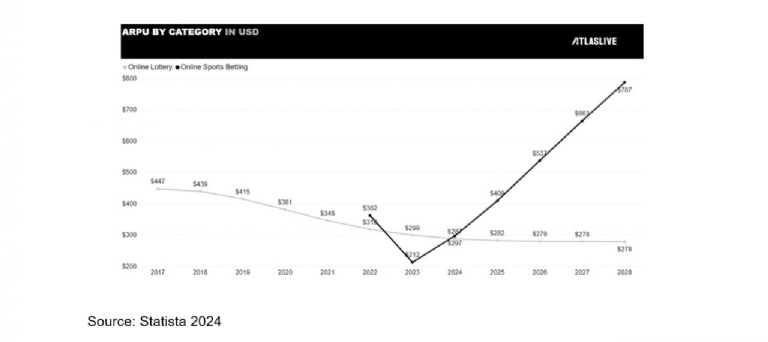

When it comes to Average Revenue Per User (ARPU), active growth is expected in the online sports betting category, despite the slower GGR growth after 2023. Meanwhile, interest in lotteries is expected to gradually decline each year. Overall, Brazil’s ARPU will see significant growth after 2023, reaching $1,576 by 2028, which is well above the regional ARPU average. This indicates that Brazil has considerably higher spending per user compared to other South American countries, making it a key market. By 2023, Brazil’s total ARPU reached $366, already surpassing the regional average of $281. From this point onward, the gap between Brazil’s ARPU and the regional average widens further.

In 2025, 79.5% of GGR growth will come from the increase in average spending, while 20.5% will be due to an increase in the number of unique players. Breaking this down by category, online sports betting will contribute 58% to GGR growth, and online casinos will account for 38%. By 2028, the share of GGR growth driven by online sports betting will rise to 71%, still largely prompted by increases in ARPU.

Users in the Brazilian iGaming Market as a Key Asset

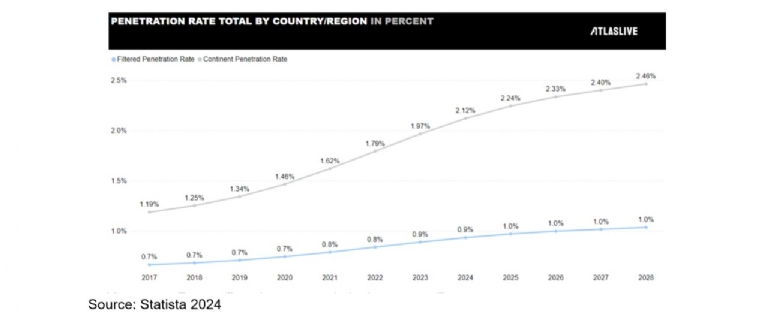

Despite a slower growth rate, the total number of players in Brazil continues to increase, though at a more gradual pace, showing that interest remains stable. The online sports betting category leads with the highest number of players across all categories, especially since 2022, underscoring its popularity and substantial contribution to the overall growth of Brazil’s player base.

In Brazil’s case, even modest penetration rates point to promising growth potential, considering the impressive increases in both GGR and ARPU. With the country’s large population, this seemingly small percentage represents around 2 million players, and it is a compelling statistic.

Starting with the basics, feedback on active gamers reveals insights by gender and age. Both primary gender groups are almost equally represented, despite some contradictory findings in earlier industry studies. The average age reported stands at 39.24. In recent years, various consumer market segments have highlighted that mass digitization has engaged more demographics than ever before. The largest age group is 25-40, with over half (57%) under the age of 49. Additionally, there is a substantial presence of middle-aged gamers and bettors, with the 41-56 age group making up over a quarter of the total (28%).

The Role of Sports Betting in Revenue Growth and Brazil’s Favorite Sports

Football is deeply woven into Brazilian culture, making it the nation’s most beloved sport. Almost everyone has a team they support passionately. The two largest clubs, Flamengo from Rio de Janeiro and Corinthians from São Paulo, each have fan bases exceeding 30 million, underscoring football’s popularity.

With daily betting opportunities, football fans in Brazil can place wagers on a wide range of leagues and tournaments. From Brazil's own Campeonato Brasileiro Série A and Argentina's Primera División to the prestigious Copa Libertadores and Europe’s top competitions like the Premier League and Champions League, football betting remains at the core.

Mixed martial arts (MMA) has also captivated Brazil, enjoying widespread popularity that has fueled a significant betting market. MMA is Brazil’s second most popular sport for online betting, following closely behind football.

Basketball has its own place among Brazilian fans, thanks to well-known players like Leandro Barbosa, Nene, and Tiago Splitter, who have represented Brazil in international leagues. This legacy has fostered an interest in betting on basketball, both locally and internationally. Additionally, volleyball, influenced by Brazil’s vibrant beach culture, is another fan favorite. Brazil's national teams consistently rank among the world’s best, making volleyball a popular sport not only for fans but for bettors as well.

The Trend of Digital Payments in Brazil and Growing Connectivity

Digital payment methods are on the rise in Brazil, and with the rollout of 5G networks, the landscape for online casinos is looking brighter than ever.

Cryptocurrencies are also becoming extremely popular, with more users gradually adopting them. While Boleto was Brazil’s go-to payment method for a long time, Pix has become the trendsetter in the past two years. Currently, around 90-98% of payments in Brazil happen through Pix using QR codes. The simplicity of Pix, which allows for single-page transactions, has truly transformed the market.

Atlaslive offers over 250 payment options, including cryptocurrencies, tailored to suit the demands of versatile igaming markets. The Atlaslive Payment Hub is not just a gateway, it’s a comprehensive solution that links operators with top local payment options. Atlaslive has a skilled team that continuously updates, optimizes, and adapts its systems, delivering seamless, full-spectrum support to help partners succeed.

Brazil’s iGaming Potential: Key Takeaways from Atlaslive

Brazil’s iGaming market holds huge potential, with its sports-loving population eager to connect with online gaming platforms. But there are challenges too, like intense competition and tricky regulations. To succeed, operators need a smart approach — strong Sportsbook software, a full-featured casino platform, and solid regulatory compliance are key.

Atlaslive’s iGaming Platform is built to help businesses navigate these challenges, offering customizable solutions. With powerful tools and a dedicated support team, Atlaslive makes it easier for partners to tap into Brazil’s growing igaming market and build a strong foothold in this exciting world with interested and active players.

__________________________________

This document is provided to you for your information and discussion only. This document was based on public sources of information and was created by the Atlaslive team for marketing usage. It is not a solicitation or an offer to buy or sell any gambling-related product. Nothing in this document constitutes legal or business development advice. This document has been prepared from sources Atlaslive believes to be reliable but we do not guarantee its accuracy or completeness and do not accept liability for any loss arising from its use. Atlaslive reserves the right to remedy any errors that may be present in this document.

Source: Atlaslive

Atlaslive, formerly known as Atlas-IAC, underwent a rebranding campaign in May 2024. It is a B2B software development company. The company specializes in creating a multifunctional and automated platform to optimize the workflow of sports betting and casino operators.

Key components of the Atlaslive Platform include Sportsbook, Casino, Risk Management and Anti-Fraud Tools, CRM, Bonus Engine, Business Analytics, Payment Systems, and Retail Module. Follow the company on LinkedIn to stay updated with the latest news in iGaming technology.