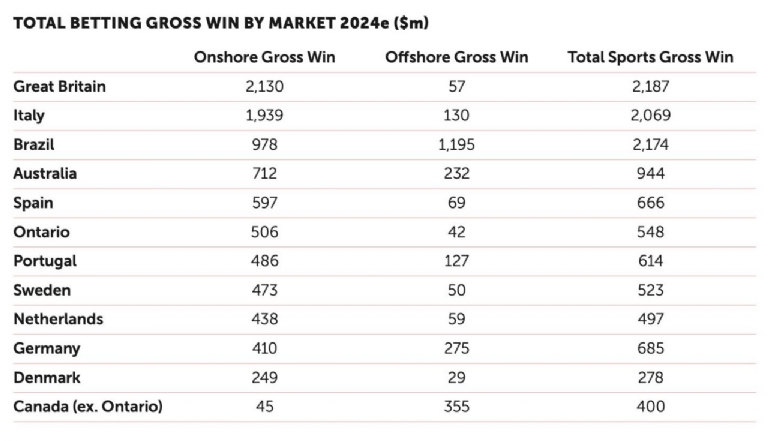

The document, which analyzes and compares the markets of Australia, Brazil, Canada, Denmark, Germany, the United Kingdom, Italy, the Netherlands, Ontario, Portugal, Spain, and Sweden, pointed out that over the last five years, online sports betting has grown more than five times faster than bets placed through physical operators (22.7% vs. 4.3% CAGR). It also highlighted that Brazil is currently the fourth-largest market in the world for the sector. Check out the full content at this link.

According to the study, based on channeling data from other regulated jurisdictions, if there were any restrictions on sports betting products in Brazil, the size of the market and onshore channeling would be negatively affected. Strict restrictions could lead to approximately US$18 billion per year being wagered on offshore operators, negatively impacting player protection and sports integrity, which are significantly lower in offshore operators as they are not subject to local rules.

The study also highlights a concerning statistic: a highly restrictive sports betting market could cost the Brazilian government US$1 billion in lost tax revenue between 2025 and 2028.

According to André Gelfi, CEO of IBJR, "It has already been proven by international experiences that restrictions and prohibitions on different sports betting markets, such as corners, yellow cards, for example, are major challenges for revenue collection." "This is something that concerns us. When we talk about sports integrity, we need to think beyond the prohibition of some categories in order to ensure the applicability of effective and safe entertainment in Brazil."

Current expectations regarding the Brazilian scenario, according to IBIA, are that a liberal market will be established in the country, with the possibility of high onshore channeling rates and tax returns of US$2.3 billion in gross winnings by 2025. H2 Gambling Capital calculates that this approach could reach US$34 billion in sports betting turnover and US$2.8 billion in onshore gross winnings by 2028.

In Khalid Ali's opinion, CEO of IBIA, the study confirms that restrictions on different betting markets are a strong and counterproductive instrument. "They do not prevent betting, they simply drive it to unregulated markets, where most of the problems with sports integrity arise. The conclusions are clear: if you want to protect consumers and sports from corruption while maximizing tax revenues, it is essential to allow a wide range of sports betting products."

David Henwood, Director of H2 Gambling Capital, added: "We always rely on data. There are many assumptions that one of the main reasons customers use offshore betting sites is because they offer a wider range of products than those available in the regulated territory. The study's results reinforce this view. Limiting the choice of onshore betting types – including live ones – is basically counterproductive."

"Instead, the most successful markets in limiting offshore gambling – evidenced by a channeling rate of over 90% – are those that have generally opened up their onshore supply to a wide choice of products. There is much to be learned here in terms of best practice regulation," said the executive.

Brazilian Institute for Responsible Gaming

The Brazilian Institute for Responsible Gaming (IBJR) was founded by the Bet365, Flutter, Entain, Betsson Group, Betway Group, Yolo Group, Netbet Group, KTO Group, Rei do Pitaco, Novibet, and LeoVegas Groups with the aim of fostering debate on the regulation of this segment in Brazil, contributing with information to advocate for the creation of clear rules and guidelines so that sports betting companies can operate legally, protecting the interests of players and civil society.

Currently, in addition to igaming and sports betting companies, IBJR has among its associates payment companies such as Grupo OKTO, Pay4Fun, and OneKey Payments, media groups such as Better Collective, advertising agency Clever Advertising, and digital marketing company Volta Pra Marcar.

International Betting Integrity Association

The International Betting Integrity Association (IBIA) is the leading global voice on integrity for the licensed betting industry. IBIA represents over 50 international gambling operators with over 125 sports betting brands and manages the largest integrity network based on customer transaction accounts in the world, covering over US$270 billion in betting volume (handle) in 2023.

H2 Gambling Capital

H2 Gambling Capital is a UK-based specialist sector analytics company and is widely recognized as the leading authority on market data and intelligence on the gambling industry. We have strong professional credibility and impartiality, and a positive track record in delivering reports that withstand scrutiny from a variety of stakeholders. Our independent analysis has helped many regulators and policymakers develop enhanced regulation and optimal market trading conditions in their jurisdictions.

Source: GMB