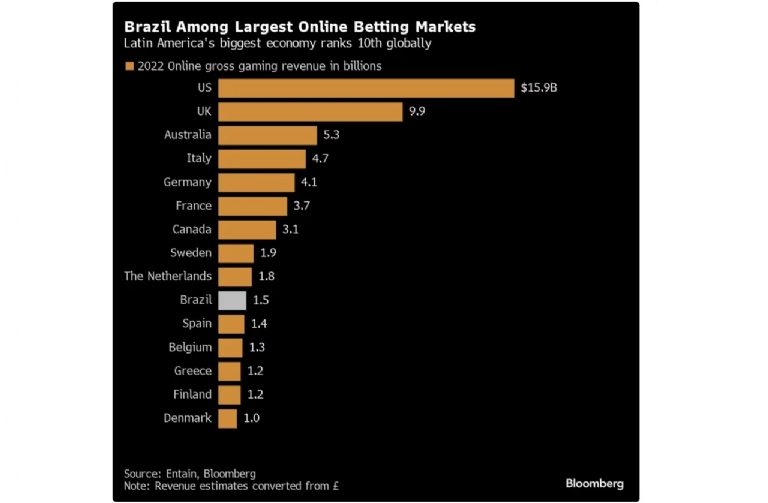

Brazil leads a regional gambling boom that followed numerous legalizations. Since it began loosening laws for online betting in 2018, the country has flourished as one of the world's top 10 markets, with gross revenues rivaling those of Spain and the Netherlands.

Now, industry analysts see the country poised for even more growth, after President Luiz Inácio Lula da Silva signed a regulatory framework last year establishing licensing fees and other requirements for companies wishing to offer fixed-odds sports betting and online casinos within the country.

DraftKings, a pioneer in online gaming, is among the more than 130 companies with pre-registration of interest in a Brazilian license, according to the Ministry of Finance. The list also includes MGM and Hard Rock International, the casino operator owned by the Seminole Tribe of Florida.

"We are excited to see Brazil approve online gaming legislation, and as one of over 100 companies that have submitted non-binding expressions of interest, we continue to explore the potential for expansion into Brazil in the future," said Griffin Finan, Senior Vice President and Deputy General Counsel of DraftKings, in an email statement.

Hard Rock did not respond to a request for comment. MGM confirmed its interest in Brazil in February, when CEO Bill Hornbuckle said during an earnings conference call that the Las Vegas-based casino operator planned to explore a joint venture partnership in the country.

"Brazil will allow online gaming for both casinos and sports betting, and we plan to be present when it launches," Hornbuckle said at the time.

Sector consolidation

But while some of the industry's biggest brands target Brazil, smaller companies are gearing up for the strong consolidation of a sector that, according to the São Paulo-based analysis firm Datahub, currently includes over 1,000 gaming operators.

The new law requires companies to pay up to R$30 million for a license that may need to be renewed every five years, depending on assessments by the Ministry of Finance.

It also creates a 12% tax on gross gaming revenues, a percentage that may be too high even for well-run small operators.

"There are many serious players who will not be able to afford this license," said Darwin Henrique, CEO of Esportes da Sorte, an online gaming company currently operating in Brazil.

Sports industry in Brazil

Known for its insatiable passion for football, Brazil has emerged as an increasingly attractive market for foreign sports leagues seeking global growth.

The number of Brazilians following the National Football League (NFL), the premier American football league, has increased more than fourfold, reaching nearly 40 million in the last decade, according to data from the sports marketing research company IBOPE Repucom.

The league has chosen São Paulo to host its first game in South America later this year.

Betting has also experienced similarly rapid growth: in 2022, Brazil ranked 10th globally with US$1.5 billion in gross gaming revenues, after not appearing among the top 15 the previous year, according to Entain, one of the largest online sports betting companies in the UK.

Total gross revenues from regulated online gaming are expected to reach nearly US$5 billion by the fifth year of operations, according to projections from the industry research company Vixio Gambling Compliance.

The popularity of online betting had already attracted multinational companies such as Bet365, Entain's Sporting Bet, and Betfair, which is among the brands owned by the Irish betting house Flutter Entertainment.

But the lack of regulation has prevented many foreign companies from formally entering the market.

The rules require companies to establish and maintain a physical presence in Brazil, and it is still unclear which operators will eventually choose to establish themselves.

But industry leaders say the possible arrival of global giants - and any consolidation that may occur - is the result of formalizing the sector, not a deliberate attempt to drive out smaller players.

"It's one of the largest markets in the world, and as it is regulated and becomes a formal market, it allows companies to enter and better exploit the system," said Wesley Cardia, former president of the National Association of Games and Lotteries of Brazil.

"And when you remove small and less reputable sites from the market, you add consumers to the big ones."

Even fearing that some may be left out of the race, operators who helped launch the online betting boom in Brazil say they will not give up easily, arguing that their knowledge of the local market will help them survive the arrival of richer multinational competitors.

"We are not afraid of competition, because we know the work we do," said Henrique. "Brazil has many peculiarities, and Brazilian bettors are different from foreigners."

Source: Guilherme Bento – Bloomber