Thus, Law 14,790/2023 returns to its original format, ensuring a fairer taxation aligned with the expectations of the sports betting and online gaming sector, which advocated for the exemption threshold and annual collection of Income Tax on the net betting results.

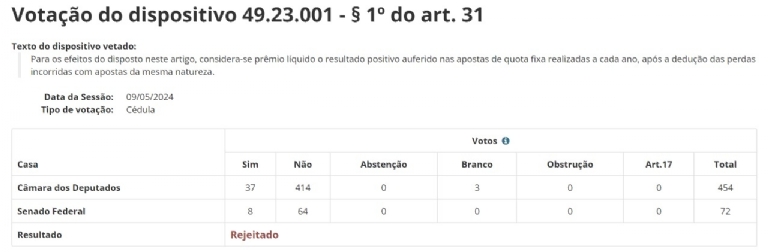

By rejecting items 1 to 3 of the presidential veto, the National Congress accepts what sector leaders had been demonstrating about the risks of bettors migrating to the illegal market. And it follows the best examples of what happens in already well-established regulated markets.

This week, the Secretariat of the Federal Revenue of the Ministry of Finance issued a Normative Instruction (2,191/2024) which already defined that up to the first exemption bracket of the progressive IR table, prizes would not be taxed.

Given the rejection by Congress of items 1 and 3 of presidential veto No. 49, the Secretariat of the Federal Revenue will have to reformulate the Instruction Normative issued just two days ago.

First repercussions in the gaming sector are positive

The National Association of Games and Lotteries (ANJL) congratulates the National Congress for the correct decision, this Thursday (09), to overturn the presidential vetoes on the sections on Income Tax on prizes from sports betting and online games of Law 14,790 /2023.

The parliamentarians decided, as ANJL and other entities in the sector had been defending, to collect the tax annually and not to levy taxation on prizes below the first IRPF exemption range.

By reestablishing what had already been approved by the Legislature at the end of last year, Congress guaranteed coherent taxation in line with what is practiced internationally, preventing the migration of players to unregulated sites, which do not collect taxes.

“In recent weeks, we have worked intensely with deputies and senators, and also with the Executive, bringing understanding about the negative impacts of maintaining vetoes on the betting market in Brazil. The result now brings relief to the sector, which will continue to work towards a fair, transparent and honest environment for both bettors and bets,” said Plínio Lemos Jorge, president of ANJL.

In relation to Normative Instruction 2,191/2024 of the Federal Revenue, published on Tuesday (7), the market now expects that, in relation to the Income Tax collection period, the rule will be adapted to Law 14,790.

Source: GMB