The extraordinary Secretary of Tax Reform, Bernard Appy, stated that before inclusion, an impact estimate must be conducted and emphasized the need for rate calibration to prevent taxation from pushing the sector into illegality. Appy mentioned he would consult the SPA (Secretariat of Prizes and Bets) to gather data and discuss the proposal with Parliament.

However, while the intention behind the measure is somewhat understandable, taxing the betting market without first consolidating proper regulation of the sector presents potential risks of fostering informality and tax evasion. According to experts, this could compromise the effectiveness of a billion-dollar tax collection in Brazil.

Firstly, it is essential to consider that the gaming and betting sector is not yet properly regulated and taxed in the country. This regulation is a complex measure involving various economic and social factors. To give an idea of the size of this challenge, the country has over 130 operators seeking licenses and projected revenue of US$3 billion by 2028.

Currently, the gaming sector in Brazil operates largely informally or in what is known as the "grey market." The expectation is that, with regulation, approximately 80% of bets will be channeled through platforms regulated and supervised by the Ministry of Finance.

However, according to international estimates, about 20% of bets may continue to operate outside this regulation.

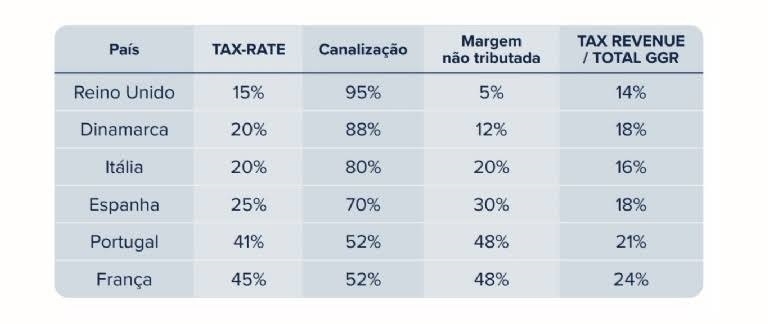

The table below shows how bets are channeled in regulated markets:

It is clear that the higher the taxation, the lower the channeling. In other words, if Brazil opts to increase taxation, it will push more bettors into illegality.

Despite having an apparently reasonable tax rate of around 12% of GGR, other regular taxes can impose a real tax burden of 30% on operations, including IRPJ, CSSL, ISS, PIS/COFINS, not to mention the “sin tax.”

Thus, the question remains: Would it be prudent to modify the tax burden before observing the practical results of the first year of regulation? The correct answer, to avoid adverse effects, seems to be prudence. This is because prematurely increasing taxes on gaming and betting could result in a decrease in channeling to the regulated market, increasing tax evasion and informality.

International experiences show that excessive tax increases on gaming can lead to a migration of bettors to unregulated platforms. This reduces the potential government revenue and may even promote the growth of parallel markets, making supervision and control even more difficult.

Considering this, it is recommended that the government wait at least one year after the initial implementation of taxation in the gaming sector before considering fiscal adjustments. This period will allow for an accurate assessment of:

Therefore, it is prudent to wait for the first year's window of taxation to properly evaluate the impacts of regulation. Any premature adjustment to the tax burden may contradict the intended objectives, reducing revenue and increasing informality. The initial observation period will be crucial to make adjustments based on concrete data and not just estimates or market pressures.

The Aigaming - International Association of Licensed Online Gaming Operators and Intermediaries and Intermediaries is dedicated to promoting the collective interests of its members and highlighting the crucial role of lotteries and games in raising funds for social causes.

Aigaming

International Association of Licensed Online Gaming Operators and Intermediaries