Amid a regulation that, on the eve of the end of the first deadline for requesting authorization to exploit fixed-odds betting in the country, operators do not have visibility of all the rules to which they will be subject.

Simultaneously, there is unexpected news that the gaming sector may be included in the scope of the Selective Tax with the advent of tax reform, raising the question:

How long will it be true that the gambling sector in Brazil is operated informally, or as the sector calls it, in the "gray market"?

The implementation of regulation simultaneously with the progress of tax reform creates a scenario of uncertainties and concerns for companies in the sector and risks the existence of a regulated market.

The International Betting Integrity Association (IBIA) and H2 Gambling Capital have prepared a report that evaluated betting regulation in 20 jurisdictions, highlighting the strengths and weaknesses of various regulatory and fiscal frameworks for betting. This study emphasized the importance of a balance between regulation and market freedom to maximize revenue collection, identifying five criteria that determine the success of a regulated market. Among these criteria, high taxation stands out as one of the most influential.

The Chamber of Deputies recently approved, in the first round, the text of the Complementary Bill that regulates the general rules of tax reform, introduced in 2023 into the Federal Constitution.

Although there are several uncertainties ahead, including the delay in the publication of the final approved text that will be sent for consideration by the Senate, the National Congress must ensure that the new tax format does not excessively burden the gambling sector, avoiding low channeling to the regulated market. This is crucial to not compromise a regulatory effort aimed at promoting conscious, safe, and responsible gambling.

In this context, channeling refers to the process of directing bets made by consumers to licensed operators subject to government regulation.

To understand whether taxation would imply maintaining the Brazilian market in the gray market, it is necessary to analyze the current tax burden on betting operators and how it might change with the implementation of tax reform.

Currently, sports betting and online gaming operators are subject to a specific allocation of 12% on the Gross Gaming Revenue (GGR), which is the gaming revenue minus prizes and taxes paid on the prizes.

Compared to other jurisdictions, we have:

With this comparison, the IBIA demonstrated the direct proportionality between the incidence of a high tax burden and the channeling of bettors to the regulated market.

Therefore, it is necessary to evaluate Brazilian taxation in the context where sports betting and online gaming companies are subject to Corporate Income Tax (IRPJ), Social Contribution on Net Income (CSLL), Service Tax (ISS), and Contributions to the Social Integration Program (PIS) and the Contribution for the Financing of Social Security (COFINS). Associated with the GGR, these taxes result in a tax burden that can reach around 46%, placing Brazil among the jurisdictions with the highest taxation.

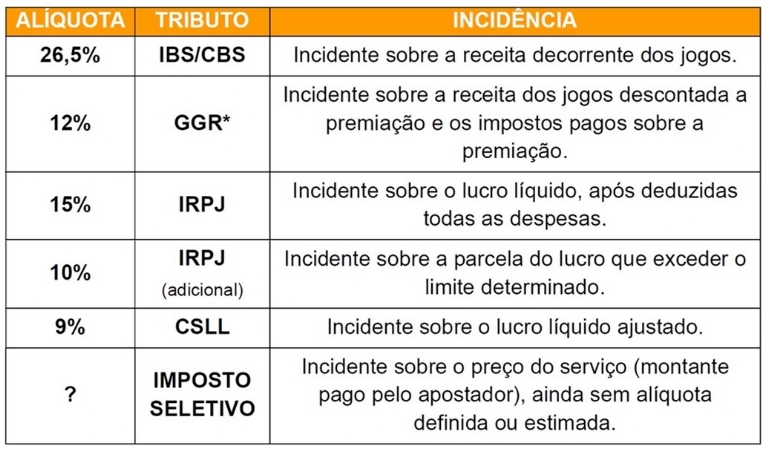

With the reform, it is already possible to foresee that revenues from lotteries and predictions, including sports betting and online gaming, will be subject to the Goods and Services Tax (IBS) and the Contribution on Goods and Services (CBS), with an estimated rate of 26.5% by the government.

Although lotteries and predictions (including sports betting and online gaming) have a specific accounting system, the rate should be the same applied to other non-benefited sectors. In addition to the mentioned taxes and the allocation on the GGR, if the Selective Tax on prediction contests is approved, we will have a scenario of possible over-taxation of the sector, especially since the rate of the Selective Tax that will be levied on the service price is unknown, that is, the amount paid by the bettor.

The possible tax scenario for sports betting and online gaming operators would be:

*This additional burden, although not of a tax nature, represents a significant cost that adds to the other taxes – not to mention that the ancillary obligations for the allocation of the 12% GGR are still unknown to the market, as the regulation that will discipline the allocation rules has not been issued.

The Brazilian Association of Sports Betting (ABRAESP) consolidated data from the Licensing System for Gambling by Copenhagen Economics 2016, demonstrating channeling in regulated markets versus the tax burden:

The experiences of other countries in their regulatory processes make it even more evident that the relationship between taxation and channeling is direct: the higher the tax burden, the lower the percentages of channeling to the regulated market.

If Brazil insists on burdening the betting sector, it is possible that the opposite effect will occur than intended by the tax authorities, and instead of increasing revenue with the advent of a new regulated sector, what actually happens is the non-channeling of bettors to the regulated market (high levels of informality) and, consequently, a reduction in the revenue intended by the government.

The logic is simple and does not require sophistication: if the government burdens the operator, they adjust their operation to bear the burden and, obviously, pass it on to the bettor through odds adjustments, less attractive prizes, and others, which may even result in the growth of the gray market.

Brazil has struggled for many years for regulation of the sector, but it is still far from being consolidated, given that there are no normative acts that discipline all the relevant aspects of a regulated market, which makes us a highly vulnerable market to the risk of regulation being ineffective and the sector becoming merely symbolic, as bettors will continue to operate in the gray market.

It is also worth mentioning that non-channeling raises an even greater concern: losing sight of the fact that the great objective of regulation is precisely to create a safe, controlled, and reliable environment for consumers to place their bets, promoting greater transparency and responsibility in the sector.

The ABAESP also raised alarming data from the experience in Portugal, which, when revisiting and updating the data between 2018 and 2023 and comparing itself with the United Kingdom (studies conducted by the UK Gambling Commission and Santa Casa da Misericórdia de Lisboa - SCML):

This means that illegal gambling in Portugal is at 75% (seventy-five percent), which means that three-quarters of consumers are consuming content that is not subject to oversight by the Portuguese regulatory agency and cannot be punished for harmful practices that do not respect responsible gambling parameters.

Given the numbers, it is imperative that Brazil finds a balance in the taxation of the betting sector to finally stop operating in the gray market. A fair tax system and clear and efficient regulation are essential to promote a safe and responsible gaming environment, prioritizing the protection of the bettor through responsible gambling and the integrity of the sector.

Ana Clara Marques de Barros Santos

Legal Director of the International Gaming Association – AIGAMING and Head of Legal at Sorte Online

Allexandre Assis Bighetti

Tax Consultant of the International Gaming Association – AIGAMING and lawyer at Dessimoni & Blanco Advogados