The SPA ordinance establishes procedures for the transfer of funds from the revenue from the fixed-odds betting lottery, as set out in §1º-A of art. 30 of Law No. 13,756, of December 12, 2018.

According to the regulation, the transfers to be made to the National Treasury's Single Account must be made through collection via Federal Revenue Collection Document (DARF).

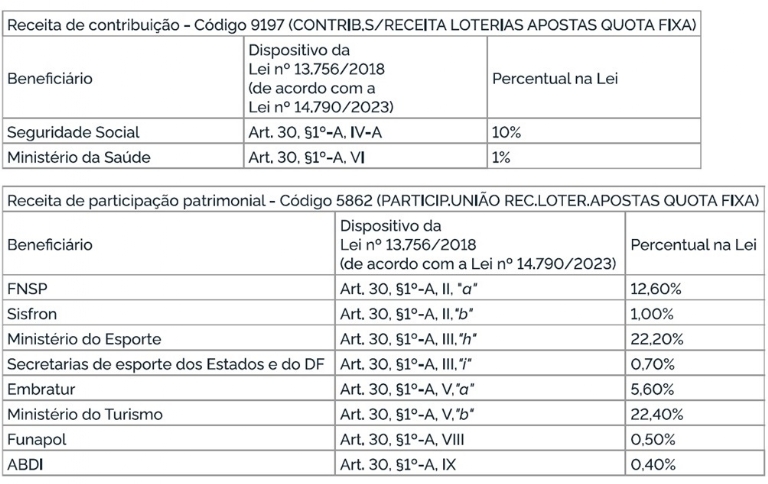

The ordinance defined two codes to be included in the DARF: 5862 (Union Participation in Lottery Rec. Fixed-Odds Betting) and 9197 (Lottery Revenue Contr. Fixed-Odds Betting).

It will be up to the operator to correctly fill out the DARF with the appropriate code for each collection method. They are subject to civil, administrative and criminal liability if they do not forward the revenues to the government.

The Secretariat of Prizes and Betting will also define, through specific guidance, how some of the transfers contained in Law 13,756/2018, which defines some taxes on the activity, will be distributed.

The transfers made to the National Treasury Single Account, through collection by DARF, were defined as follows:

Source: GMB