Starting next year, the so-called 'Bets' will need to pay for a license to operate online betting and gaming businesses in Brazil. The amount is R$30 million (US$ 5.35m) and allows exploration of the market for five years, with up to three different brands per company.

The measure is part of a comprehensive legislation, inspired by international models, which aims to regulate the sector so that it continues to exist, generates jobs in the country and raises funds for the government.

Considering the little over 100 companies already registered, just by paying the R$30 million concession fee to operate the betting market in the country, the government will collect an estimated R$3 billion (US$ 535m) from 2025.

According to experts, the fee will take away significant revenue from 'Bets', which currently goes both to entrepreneurs' pockets and to marketing investments. In addition, the law could create a major filter in the sector, leaving only a few companies operating in Brazil.

The expectation is that the market will become more professional than ever before and that the legislation will free up money for mergers and acquisitions and venture capital investments.

The new law also provides for a fine of up to R$2 billion (US$ 356m) for companies that operate the Brazilian online betting market without paying the concession fee to the government.

The financial entry barrier to the national market was imposed by the Secretariat of Prizes and Betting (SPA) of the Ministry of Finance in May of this year. Companies have until December 31, 2024 to comply with the new rules. They will also need to have R$5 million (US$ 890,000) in cash guarantees.

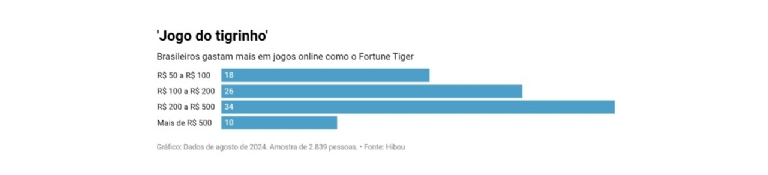

With the payment of the concession fee, companies can operate in both sports betting and online games, including roulette, casino, poker and others. In other words, games such as Fortune Tiger will also need to pay for the license or they may leave the country.

From an economic standpoint, businesspeople in the sector say it makes no sense to stop operating in every possible way to make the operation viable, especially with the 12% tax, in addition to state taxes.

According to estimates by online traffic company SEMRush, bet365, Betano and Betfair are currently the companies with the largest audience numbers, and are therefore the players' favorites.

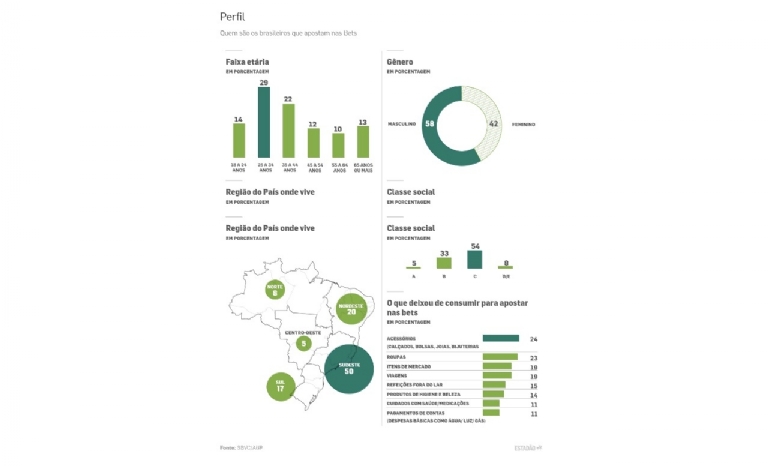

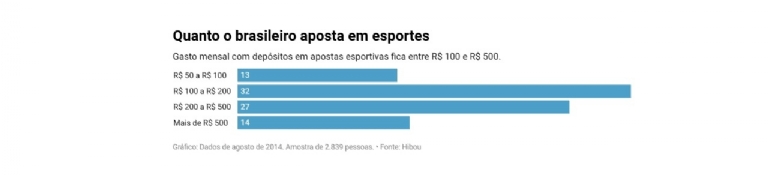

In the monthly average for the last 12 months, betting sites had 194.2 million visits. Brazil is among those with the largest audience on these platforms, despite not yet being among the largest in terms of revenue.

Charging taxes on betting houses is a strategy by the Minister of Finance, Fernando Haddad, to increase tax revenue, through the collection of taxes and concessions. The government estimates that the revenue from the new legislation will be between R$12 billion (US$ 2.1bn) and R$15 billion (US$ 2.7m) per year.

Limitation of studies

In the view of Magnho José, President of the Instituto Jogo Legal (IJL), which represents the sector, the Brazilian betting market reached its current stage due to the lack of regulation within the initially planned deadline. In the proposal by Michel Temer's government, the sector should have been regulated within two years, with a deadline extendable for another two.

With this postponement, the sector spent four years without clear rules. For José, the postponement was due to the religious caucus in the Chamber. "He (Bolsonaro) did not regulate the modality and the market grew wildly. By not regulating, it ended up allowing and encouraging these companies to use the resources they would use to pay the concession and to pay taxes to invest in advertising”, he says.

José also says that the current legislation follows the best global practices and will be beneficial for companies operating in the country. He points out that the lack of regulation makes it difficult to accurately measure the size of the national 'Bets' sector, as well as any impacts on the economy.

“The regulation of sports betting in Brazil will allow the Ministry of Finance to monitor in real time the transactions and balances of bettors’ accounts on betting sites. Currently, there is no precise information on how much money bettors have in these accounts, making it difficult to control and analyze data. With the new regulation, starting in January, the government will have access to this data, allowing it to identify suspicious movements, such as large bets on unlikely teams, which will facilitate the detection of match-fixing and control over betting operations in Brazil,” he says.

The Central Bank informed Estadão that it does not have specific data on the betting market, which is reported together with health, education and culture expenses. Therefore, studies that measure the size of the sector, the expenses and the positive or negative impact on the national economy are estimates.

The president of the IJL states that the Brazilian market began to receive several Chinese websites in 2024, seeking to explore the market before the regulation imposes a new entry barrier for the sector and prevents easy and quick gains in the country. For José, if there are no further changes in the legislation by the end of the law's term, the market tends to develop healthily in Brazil, attracting serious companies and investments.

Source: Estadão