The regulation of sports betting and online gaming in Brazil is beginning to put an end to the spread of companies that have exploited the national market almost unrestrictedly since 2019.

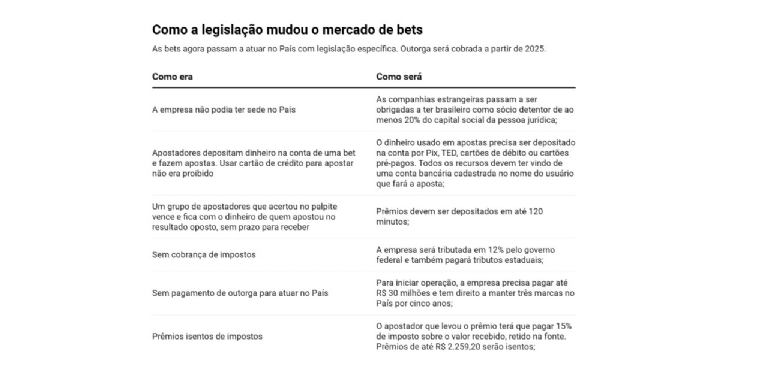

Under the new laws, companies not only have to pay taxes, follow strict rules regarding prize payments to bettors, and ensure protections against money laundering and terrorism, but they also need to pay for a license to operate in the sector starting in 2025.

With this legislation, the expectation is that it will mark the end of the "Wild West" in the sector. However, for this to happen, the new "sheriff" will need to be strict in enforcement, a challenging task. The responsibility will lie with the Secretariat of Prizes and Bets, linked to the Ministry of Finance. Not surprisingly, the number of thousands of companies will initially be reduced to just over a hundred. In 2023, the sector's revenue was estimated at R$ 100 billion (US$ 17.8bn).

The online betting market was authorized by former President Michel Temer (2016-2018) in the last month of his term, with regulation required two years later, a deadline that could be extended by another two years.

As a result, Jair Bolsonaro's government (2019-2022) spent four years without addressing the issue, which ended up in the hands of President Luiz Inácio Lula da Silva and Finance Minister Fernando Haddad.

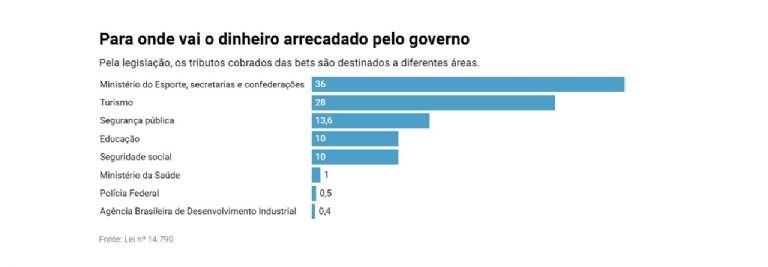

In Law 14,790, dated December 29, 2023, the government established a series of measures related to the payment of taxes, including a 12% tax on the revenue of betting companies, detailing the destination of the funds, and also set protections for bettors, who must receive their prizes within a maximum of 120 minutes.

Previously foreign companies are now required to have a Brazilian partner who owns at least 20% of the business's share capital. Advertisements promising easy gains or targeting minors are now prohibited. With taxation, the government expects to collect R$ 12 billion (US$ 2.15bn) in 2024.

Starting in 2025, the entry barrier will be R$ 30 million (US$ 5.35m) for operating three brands in Brazil for five years, and companies will also need R$ 5 million (US$ 890,000) as a bank guarantee for the business. Those operating without the license next year will be subject to a fine of up to R$ 2 billion (US$ 355m).

"Previously, companies could exploit the market but could not be in the country. All companies used foreign licenses. The money passed through Brazil but did not stay here. Moreover, consumers did not have the same protection they do with a national company," says Leandro Pamplona, a lawyer specializing in the betting segment and co-founder of Bonetti, Krugen & Pamplona Advogados Associados.

According to a study by PwC, for each bet, the "house" takes an estimated fee of 12% of the wagered amount—part of which is used to keep the operation running, with the rest being profit.

For Magnho José, president of the Instituto Jogo Legal, the betting market in Brazil will change completely starting January 1st. "All the problems we see today will cease to exist. What happens now is due to the lack of regulation. The R$ 2 billion (US$ 355m) fine hurts any company's margin," he says.

The institute estimates that over 90% of bets are made via Pix or bank deposit, but a decree from the Secretariat of Prizes and Bets already bans the use of credit cards to prevent debt, a concern for the Brazilian Federation of Banks (Febraban).

Betting companies view the legislation as positive for the development of the market, which, despite the new impositions, can continue to exist in Brazil.

"The rules will bring order to the market, which grows every day but in an uncontrolled way. Many people believe it's a market where you can take a risk and create a betting site overnight, but it's not like that. And, of course, the ones who suffer the most from this are the bettors themselves," says NossaBet, a betting company operating in Paraná, in a statement.

Ueltom Lima Gomes, CEO of H2, which started in the poker market and owns H2Bet, states that although Brazil took many years to regulate betting and online gaming, the market offers many opportunities. But previously, these were only exploited by companies with a higher risk appetite, and that is expected to change, especially from 2025 onward. "Taxation is painful for the entrepreneur, but it's vital for the rules. It filters out those who want to work seriously," he says.

Gomes is betting on his company's 20-year history in the Brazilian market to differentiate itself in the online betting sector, which includes many companies from countries like the United Kingdom or those based in tax havens.

"We have a relationship with the Brazilian market that is already well-established, and we have knowledge of the country. International companies engage in an aerial war. It’s important to have operations on the ground, to know Brazil and Brazilians."

Marcio Borges Malta, CEO of Sorte Online, states that the company has been operating in Brazil for 21 years, intermediating lottery bets, and has now entered the sports betting and online gaming segment. He says the business has the potential to become the company's main focus, which is still in lotteries.

"We hear a lot of criticism about betting, but there's a big difference in the return to the player between betting products and lottery games. Consumers are smart. They wouldn't be betting so much if there weren't a quality entertainment experience. People bet more on sports betting because the return is higher. In online games like Tigrinho or Aviator, the prizes pay out an average of 95% of the total wagered. Many people win, and many lose," Malta explains.

The business owners emphasize that betting is meant for entertainment and is not an investment, despite the (not guaranteed) possibility of gains.

According to Professor Moacyr Alvim from FGV's School of Applied Mathematics (FGV EMAp), sports betting has an inherent unpredictability factor due to the nature of competitions, such as football games, making the probability model for each match unknown.

"We have some clues about how it works through the odds. What the house pays out reflects, to some extent, the probability of winning and losing. If the odds are 3 to 1, the inferred probability is?. This gives a hint of how the probability is inferred by bettors. But the actual probability of a team winning is something no one knows for sure. In a roulette game, the probability of winning is known exactly. If it's red and black, the probability of red is almost 50%, slightly less due to the presence of the zero," he explains.

Alvim emphasizes the importance of viewing betting as entertainment rather than an investment and knowing when to stop. "If a person plays for a long time, the expected profit is negative."

A recent decree from the Secretariat of Prizes and Bets also mandates that betting companies must monitor the behavior of users who may become dependent or pathological gamblers. A fine of up to R$ 2 billion can also be applied in such cases.

Mergers and acquisitions

According to experts, the new laws provide more stability and security to unlock investments in Brazil's betting sector, both for the consolidation among current market leaders and for the acquisition of foreign companies.

"Brazil has achieved regulation that allows for investment, collects taxes, creates jobs, and removes amateurs from the market, who typically have a bad track record in the country, often closing shop and disappearing. Starting in 2025, this market will be able to contribute to Brazil and bring more seriousness," says Brunno Galvão, CEO of the American venture capital fund Cronwstone Ventures, which plans to invest up to R$ 300 million (US$ 53.5m) in the national market in 2025.

Currently, the fund operates with R$ 50 million (US$ 8.9m) and has companies like NoHype, an affiliate marketing firm for betting and other brands, and Elisa.bet, in the betting segment.

For Galvão, Brazil will initially go through a phase of combating illegal companies before moving on to a consolidation stage in the sector, with mergers and acquisitions expected to lead to a few major players dominating the national market.

Economist Adam Patterson, a partner at Redirection International, states that Brazil has unique conditions for the growth of the betting sector, which he estimates will see a 50% annual revenue increase until 2028. Therefore, the legislation is expected to attract investments to the national market. However, this should not be the only factor. As the competition for customer preference requires large volumes of investment in marketing, the merging of operations will be a way to reduce expenses and create more profitable businesses.

"With the new regulatory costs, there will be a push for M&A (mergers and acquisitions) operations. But this will also happen due to the cost of operations and marketing. We will see international companies buying national ones, and we will also see mergers," he says.

Patterson notes that deals have already been closed in the country even as the legislation was taking shape and starting to be implemented. Two examples, he says, were Better Collective's acquisition of Torcedores.com last year and Esportes da Sorte's acquisition of Grupo Loyalty earlier this year.

Source: Estadão