Can a successful gaming business be developed within this legal framework? Are players and operations truly protected? These are critical questions for anyone considering Colombia as a key market.

The piece uncovers important market figures, shifting customer preferences, and emerging trends. It also provides insights into the country’s legal base, helping iGaming businesses understand how to leverage Colombia’s impressive growth potential and expanding player base in online gambling, not only for 2025 but for the years ahead.

Colombia's journey to a regulated gambling industry

Gaming in Colombia has evolved from a cultural pastime to a fully regulated industry. Before legalization in 1943, informal gambling activities like card games, cockfighting, and lotteries were deeply rooted in Colombian society. The 1943 legislation marked the first step toward formalizing the industry, requiring operators to pay taxes and establishing a foundation for future regulations.

Key milestones followed, including the creation of ETESA, a government agency, in 1993 to oversee gambling activities. While ETESA faced corruption challenges, its dissolution in 2011 led to the establishment of Coljuegos, a regulatory authority ushering in a new era of transparency and stringent oversight.

A breakthrough came in 2016 with the eGaming Act, positioning Colombia as a pioneer in Latin America by fully legalizing online gambling. The first online gambling license was issued in 2017, setting the stage for a regulated, thriving market.

Colombia's gambling regulations have since become some of the most advanced in South America. Operators must adhere to strict KYC and AML protocols, technical standards, and responsible gambling measures introduced in the 2020s. These regulations ensure financial transparency and player protection while strengthening a competitive environment for both local and international operators.

Today, Colombia offers a legal and well-structured gambling market, requiring operators to establish a local presence and comply with rigorous standards.

Atlaslive gives priority to secure and responsible gameplay by equipping partners with advanced Risk Management and Anti-fraud tools and data protection. The platform features a robust anti-fraud system that detects and prevents risks such as account takeovers, arbitrage betting, money laundering, etc. Real-time analytics monitor unusual betting patterns, quickly spotting issues to protect operators and players.

To provide compliance and platform integrity, Atlaslive offers customizable geolocation services and intuitive user management features, helping operators meet regulatory standards effortlessly. Its advanced KYC framework includes automated document checks, 3D facial recognition, and real-time biometrics, providing a secure, seamless experience.

These measures, combined with powerful business analytics, enable operators to maintain transparency and create a safer gaming environment for everyone.

Colombia’s progress among South America’s iGaming giants

Colombia’s gambling market has seen steady growth, much like Peru’s, driven by the legalization and development of online gaming. Between 2017 and 2021, the Gross Gaming Revenue (GGR) experienced a notable rise, reflecting the influence of a well-regulated online gambling industry. This upward trend highlights the country’s potential for further expansion in the following sector.

The online gaming market of Colombia continues to grow steadily but in comparison with other game-players of South America that are rapidly expanding across the region, it still lags behind.

By 2025-2028, Colombia is expected to account for 23-25% of the region’s GGR, positioning it as one of the key drivers in South America’s iGaming sector.

However, the sudden jumps in regional GGR growth in 2020 and 2023 were caused to a greater extent by the dominant markets of Argentina and Brazil. These two regional giants are ahead in South America, thanks to their advanced strategies and robust iGaming developments. While Colombia contributes much to the region's progress, Argentina and Brazil continue to set the pace, forming the iGaming future in South America with their major market shares and innovative approaches.

iGaming in Colombia: total revenue by three main categories and ARPU

Online sports betting has emerged as the top category in Colombia’s online gaming market, contributing a palpable 66% of the GGR since 2022. This trend reflects the country’s passionate sports culture, where Colombians are loyal fans of their favorite teams and events. Legalizing online sports betting has further boosted this category, creating opportunities for local and international operators to develop and grow here.

Colombians have a long-standing love for football, which dominates the betting surrounding. Major tournaments like the FIFA World Cup, Copa América, and domestic leagues such as the Categoría Primera A draw massive betting interest. Fans place wagers on match outcomes, player performances, and even live in-play events, making sports betting an integral part of the fan experience.

In addition to football, other sports such as basketball, cycling, and boxing also enjoy popularity, with Colombians keen to support their national athletes on global stages. Horse racing and tennis are growing segments, attracting bettors with their dynamic gameplay and varied betting options.

Interestingly, esports betting occupies its niche in Colombia, particularly among younger demographics. Games like League of Legends, Dota 2, and Counter-Strike: Global Offensive are gaining popularity. Increasing internet penetration, accessible streaming platforms, and the appeal of competitive gaming events support this growing trend. As the eSports industry expands globally, Colombia’s market is beginning to welcome this new style of modern betting, offering operators a chance to engage a tech-savvy audience.

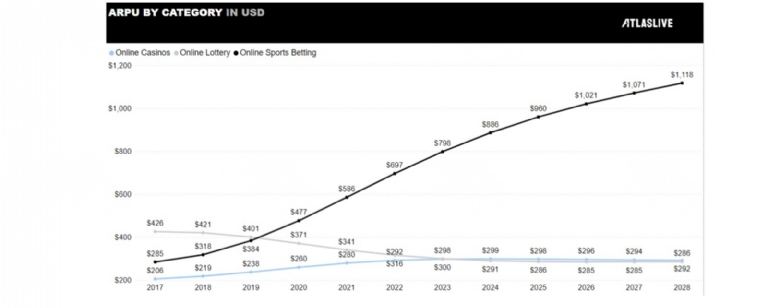

Online sports betting isn’t just growing — it’s dominating. Since 2017, it has shown the fastest growth among all categories, and by 2025, the average revenue per user (ARPU) for online sports betting is projected to triple that of other categories, surpassing $1,100. By 2028, it will continue to soar, strengthening its position as the favorite pastime for a growing audience. This surge speaks volumes about the enthusiasm and deep interest users have in sports betting.

In stark contrast, online casinos and lotteries tell a quieter story. Their ARPU remains relatively stable, hovering below $300, with only minor fluctuations. This reflects a more modest player interest or a market with steady but less dynamic growth.

The gap between ARPU for online sports betting and other categories will widen dramatically by 2025 and beyond. Sports betting is not just the leader — it’s the engine driving the future of gaming revenue growth.

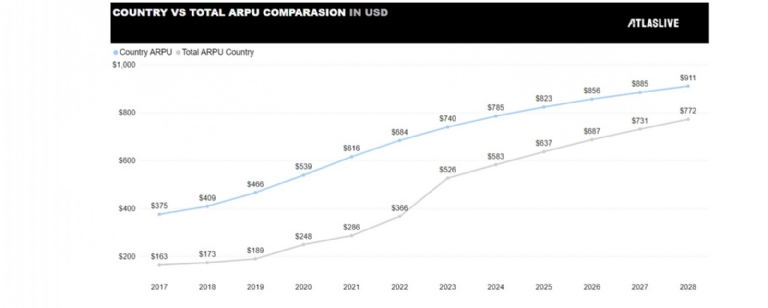

Colombia's ARPU is growing faster than the South American average. By 2025, it is expected to be 30% higher than the regional average, highlighting Colombia's strong position in the gaming sector and potentially higher spending power among its players.

This upward trend continues through 2028, when Colombia’s ARPU is projected to reach $911, compared to the regional average of $772. Since 2020, Colombia’s ARPU has consistently outpaced the region, with the gap widening each year. This suggests better growth conditions or stronger demand for gaming services in Colombia than its neighbors.

Colombian players: penetration rate and total unique players attracted

iGaming in Colombia continues to expand, with the number of unique players projected to grow from 0.64 million in 2017 to 2.08 million by 2028. However, growth rates have slowed since peaking at 17.46% in 2021, indicating a maturing market. Starting in 2024, demand for online sports betting and online casinos appears balanced, showing that both categories share similar popularity.

With many players likely engaging in both sports betting and casino games, there is significant potential for cross-selling and boosting participation across these categories. As the market matures, future growth will rely on innovation and player retention rather than just attracting new users.

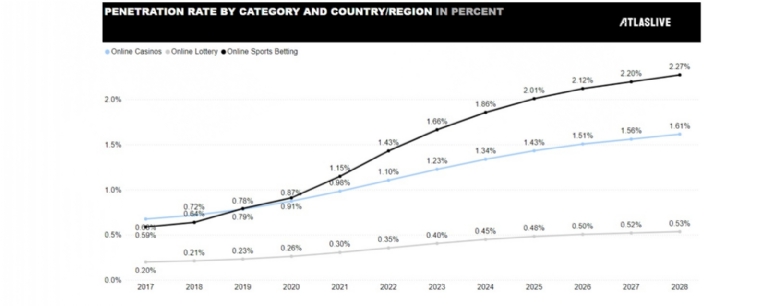

Colombia boasts one of the highest gambling penetration rates in South America, second only to Argentina. By 2028, the overall penetration rate is expected to reach 3.9%, significantly outpacing the regional average of 2.46%. This high demand highlights Colombia’s strong position as a leader in the region's iGaming sector, particularly in online sports betting, which will achieve a penetration rate of 2.27%, followed by online casinos at 1.61%.

In 2025, Colombia is predicted to rank third in South America for GGR and unique players, with an ARPU of $823 — 29.3% above the regional average. Online sports betting (79.6% of GGR growth) and the increasing number of unique players (62.6% growth) will drive the market's expansion, solidifying Colombia as a key player in the region’s iGaming landscape.

Key takeaways

Due to strong analytical capabilities and a robust base, the Atlaslive iGaming Platform finds South American market research valuable for enhancing its customizable features and supporting partners.

Today, any emerging or rapidly developing iGaming market demands dynamic technologies that can fulfill the evolving needs of users and operators. The Atlaslive Platform offers comprehensive and adaptable solutions, meeting all the essential requirements for success in online gaming.

From an innovative Sportsbook and diverse casino offerings to essential tools like the Payment Hub, CRM, Bonus Engine, and more, Atlaslive equips partners to remain competitive and efficient in this fast-paced industry.

In a region brimming with potential and fierce competition, Atlaslive stands out. With the right strategies and cutting-edge technologies, operators can achieve remarkable results and boost the user experience. The Platform maximizes its advanced capabilities to help partners thrive. Our approach to markets mirrors our relationship with our partners: dedicated, customizable, and flexible.

Step into the future of iGaming with Atlaslive.

Source: Atlaslive